Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Too Little Customer Interest Scuttles TGP’s NED Project

Tennessee Gas Pipeline Co. (TGP) has cancelled its Northeast Energy Direct (NED) pipeline project after drawing too few customers, the Kinder Morgan Inc. (KMI) pipeline said Wednesday.

The proposed pipeline, which drew scores of protests from landowners and public officials (see Daily GPI, Dec. 31, 2015), would have helped lower high natural gas and power costs faced by New Englanders, particularly during the winter months when natural gas prices spike.

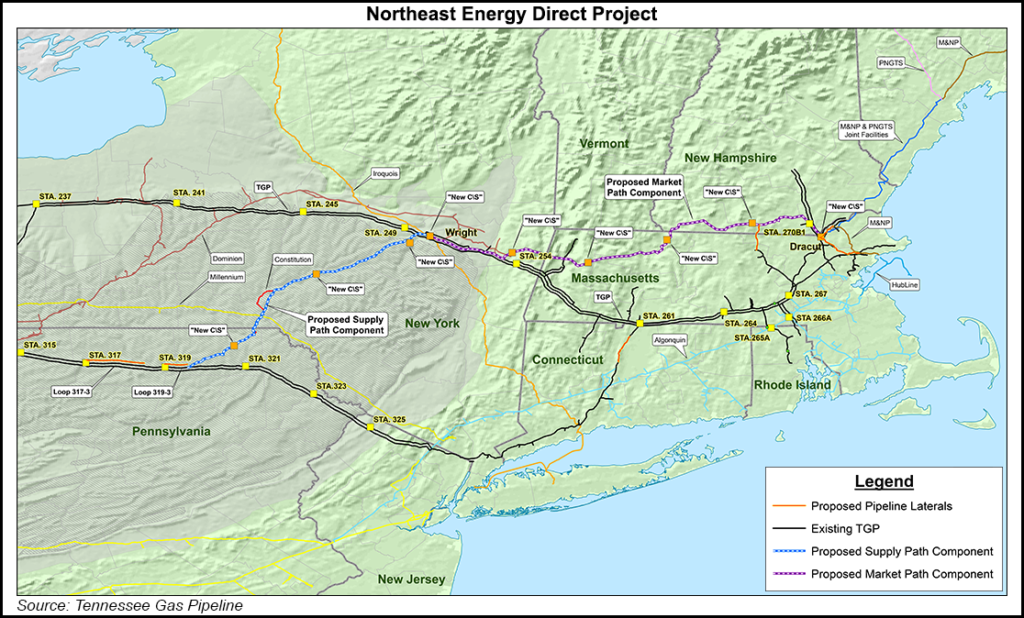

Costing about $5 billion in its entirety, NED would have expanded the TGP system in Pennsylvania, New York and New England, connecting Marcellus Shale gas from northern Pennsylvania to consumers in New York and New England.

Last July, the KMI board gave the go-ahead for the project’s market path segment from Wright, NY, to Dracut, MA (see Daily GPI, July 16). The board had yet to approve the supply path portion of NED. A November filing at the Federal Energy Regulatory Commission was for the entire project and was made up of more than 240 files totaling more than 20,000 pages (see Daily GPI, Nov. 20, 2015).

At the time of the NED market path approval, $3.3 billion was allocated to the project and it was placed in KMI’s project backlog. The supply path had not been approved for funding and was not in the backlog.

Overall, KMI’s project backlog has been reduced to $14.1 billion at the end of the first quarter, down from $18.2 billion at the end of the fourth quarter. The reduction reflects the elimination of NED’s market path as well as the cancellation of the Palmetto Pipeline project to carry refined products (see Daily GPI, March 31).

KMI said on Wednesday that the initial board approval of the market path segment was based on existing contractual commitments at the time by local gas distribution companies (LDC), as well as expected commitments from additional LDCs, electric distribution companies (EDC), and other market participants in New England.

“We worked very hard to get customer commitments on the project,” KMI CEO Steven Kean told analysts during an earnings conference call Wednesday afternoon. “And while many of our LDC customers did sign up, we did not receive enough contractual commitments from electric customers to make the project viable. So we will fulfill our obligation to consult with our customers over the next 30 days or so, but this project is not economic, so we’re removing it from the backlog. In both cases, NED and Palmetto, based on all the facts, we believe this is the right outcome for our investors.

“To be specific, the return on the NED project at the level of commitments that we have would be less than 6% unlevered after tax. That’s clearly not viable, and we are far better off having that cash available for other uses, whether that’s continued and even accelerated delevering, other investment opportunities or returning value to shareholders.”

KMI said the insufficient contracted capacity on NED’s market path was due to several factors.They include the fact that the New England states have not yet established regulatory procedures to facilitate binding EDC commitments, that the process in each state for establishing such procedures is open-ended and that the ultimate success of those processes is not assured.

At the supply end of the pipeline, the depressed commodity price environment has made it too challenging for producers to step up for capacity on NED as well, KMI said.

“Further, current market conditions and counterparty financial instability have called into question TGP’s ability to secure incremental supply for the project,” KMI said.

TGP will continue to work with customers on alternatives to address New England’s natural gas needs, particularly those of LDCs, KMI said.

NED faced competition from a smaller project proposed by Spectra Energy Corp. called Access Northeast, which targets gas-fired power generation in New England (see Daily GPI, Feb. 4; Sept. 18, 2015).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |