Marcellus | E&P | NGI All News Access | Regulatory | Utica Shale

Three E&Ps Ordered to Plug 1,000-Plus Abandoned Wells in Pennsylvania

The Pennsylvania Department of Environmental Protection (DEP) has ordered CNX Resources Corp., XTO Energy Inc. and Alliance Petroleum Corp. to plug more than 1,000 abandoned wells across the state.

The agency issued separate administrative orders to the exploration and production (E&P) companies earlier this month and said that each has failed to follow state law by not plugging the wells.

“It is critical that all operators adhere to state laws to mitigate the environmental and public health and safety hazards and not add to the costly orphaned and abandoned well inventory that would otherwise fall on the shoulders of Pennsylvania citizens,” said DEP Secretary Patrick McDonnell.

Citing the Pennsylvania Oil and Gas Act, the agency issued orders for Alliance, a subsidiary of Diversified Gas and Oil plc, to plug 638 abandoned wells; CNX to plug 327 of them and XTO to plug another 93.

The law states that a well is abandoned if it hasn’t been used to “produce, extract or inject any gas, petroleum or other liquid within the preceding 12 months.” The wells in question, DEP said, did not produce oil or gas during the 2017 calendar year. The law also requires owners and operators to plug wells upon abandonment and companies must provide schedules that prioritize those operations. The agency said the companies have not submitted such a schedule.

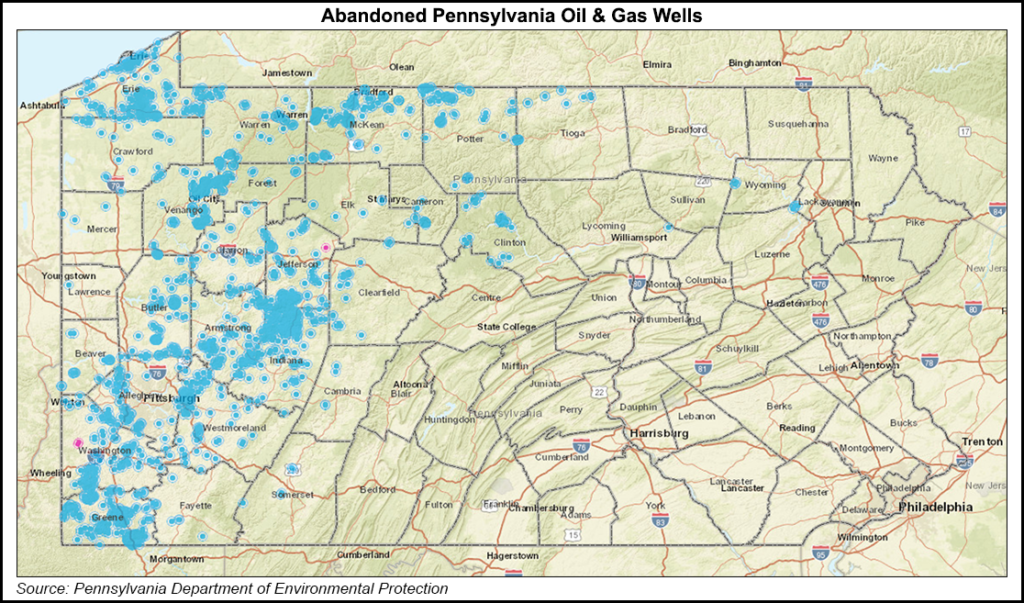

The DEP estimates that hundreds of thousands of oil and gas wells have been drilled in the state since 1859. Much of that activity predates the agency and applicable regulations. Currently, DEP estimates that up to 560,000 wells are abandoned across the state.

DEP has repeatedly sounded off on the issue. While E&Ps across the state share in the responsibilities, Diversified has recently been on a buying binge throughout the Appalachian Basin, amassing more than six million acres of mostly legacy properties. CNX predecessor Consol Energy Inc. has operated in the region for more than 150 years and ExxonMobil Corp.’s onshore subsidiary XTO has taken on a sizable position by acquiring legacy companies.

“Making sure that abandoned wells are plugged is and has been a priority for DEP,” said agency spokesman Neil Shader of the orders. DEP often works with operators to schedule plugging, but it wanted to ensure the work is done, because “the situation that DEP wants to avoid is that current operators will walk away from their obligation and add to the existing inventory of orphan and abandoned wells.”

CNX spokesman Brian Aiello said the company is currently evaluating the order. CNX only recently separated from the coal business and in 1Q2018 completed that step by divesting the last of its shallow oil and gas assets. Aiello said it appears that at least 190 of its wells in question were included in the recent sale of those assets, “meaning the buyer is ultimately responsible for those wells.” As for the rest, “we have always worked cooperatively with the DEP to meet our well plugging obligations and we expect to continue to do so going forward.”

Indeed, at the time of that sale, CNX said the buyer assumed $200 million in liabilities that were primarily related to asset retirement obligations. While unrelated to the DEP’s order, Diversified also recently purchased EQT Corp.’s Huron formation assets in Kentucky, Virginia and southern West Virginia, taking on what EQT said are $200 million of plugging and other liabilities associated with the assets in an indication of the responsibilities that come with such properties.

XTO spokesman Jeremy Eikenberry echoed CNX, noting that the 93 wells covered by the order were actually sold in a broader sale of 5,200 shallow conventional wells to Alliance last year. “We will work with the Pennsylvania DEP, along with Alliance Petroleum Corp. and their successor, to develop an appropriate response.”

DEP’s orders include deadlines by which each company must plug the wells. The order also directs each company to provide copies of well inspection records, document the plugging work and remediate each well site according to state regulations.

An amendment to the 2012 Pennsylvania Fiscal Code set bonding amounts for conventional oil and gas wells at $2,500 per well or a blanket bond of $25,000 for all wells owned by an operator. Costs can vary greatly depending on the well conditions, but generally run between $10,000 and $100,000 per well.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |