NGI Data | Markets | NGI All News Access

Threat of Colder Weather Before Year’s End Sends Natural Gas Winter Futures Surging; Spot Gas Rises

Natural gas traders were not taking any chances in holding short positions on Friday given continuously fluctuating weather forecasts. The Nymex January gas futures contract rocketed 16.1 cents higher to settle at $4.488, while February climbed 16.1 cents to $4.378 and March rose 23.1 cents to $4.155.

Spot gas prices also strengthened as strong national demand was expected to continue through the weekend with morning lows forecast to drop to as low as zero in parts of the northern two-thirds of the country. Even the South and Southeast were forecast to see overnight temperatures in the 20s and 30s, aiding in the strong weekend demand. Substantial losses of more than $1 in the Rockies and California, however, helped send the NGI Spot Gas National Avg. down 9 cents to $4.66.

On the futures front, price direction was firmly established before the official start of Friday’s session as the Nymex January contract was up more than a dime overnight Thursday. At the heart of those gains were hints that chillier temperatures could arrive before the end of the month.

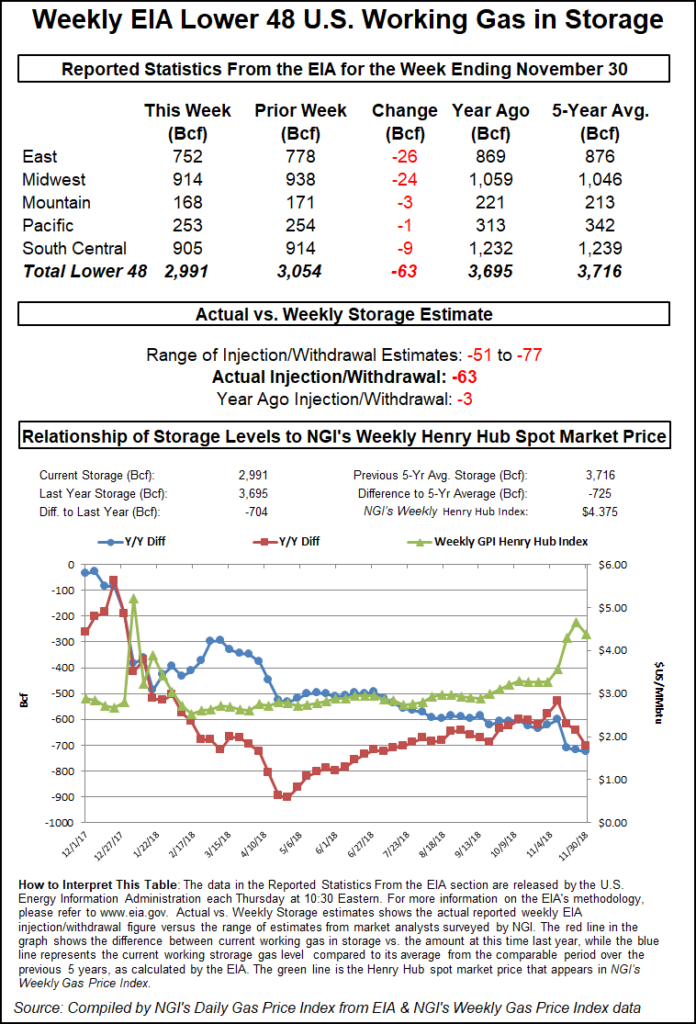

Prices maintained those gains even after the Energy Information Administration’s storage report, which showed a 63 Bcf withdrawal from storage stocks for the week ending Nov. 30. The reported draw was viewed as somewhat of a snoozer, even as it fell on the high side of expectations. Most estimates had clustered around a withdrawal in the low to mid-60s Bcf.

“This moderately tighter print misses in about the same direction as last week’s print missed loose; we had expected slightly more lingering holiday impact in the number and were surprised by the size of the draw in the South Central,” Bespoke Weather Services said.

In fact, a larger 9 Bcf draw in the South Central accounted for almost the entire miss, the firm said. “We see this as indicating the market is slightly tighter than we had been expecting, and are looking for a tighter number to be announced next week with production off solidly over the last few days,” Bespoke chief meteorologist Jacob Meisel said.

This should make it harder for prices to fall off meaningfully unless long-range cold risks ease as such a print will keep storage concerns elevated, “and we would be surprised to see next week’s print do much to ease those concerns,” he said.

The EIA reported a 26 Bcf withdrawal in the East, a 24 Bcf pull in the Midwest and a 9 Bcf draw in the South Central region. Salt caverns in the South Central region, however, reported a 4 Bcf injection.

Inventories as of Nov. 30 sat at 2,991 Bcf, 704 Bcf below year-ago levels and 725 Bcf below the five-year average, according to EIA.

Even though this week’s storage report failed to move the needle much, colder weather is expected in the next few weeks, and the risk to upside is certainly there, market observers said.

If long-range weather models that are currently showing a return to colder weather come to fruition, then the February contract could move into $5 territory, according Wood Mackenzie natural gas analyst Gabe Harris.

“Everyone only wants the strip further out to go up so they can have a good multi-month short opportunity,” Harris said Friday in a social media energy chat room hosted by The Desk.

As for the next several days, weather outlooks showed a strengthening weather system tracking across Texas and the southern United States with heavy rain, falling as snow or ice into the coldest air, according to NatGasWeather. Mild high pressure remained on track to build across the central and northern United States early in the week, then shift over the North and East, easing national demand to lighter levels, the firm said.

In fact, in its midday run, the Global Forecasting System model was a little milder through the middle of the week, but then a little colder Dec. 16-22 on slightly stronger weather systems across the southern half of the country. However, daily forecast heating degree days should remain below the 30-year average, NatGasWeather said.

“Overall, the main issue is the northern United States, where cold air over Canada needs to prove it will push back across the border and where the data has yet to show when that will be. It helps there will be some demand from southern U.S. weather systems, but truly frigid air will be needed to return for solidly bullish weather sentiment,” the forecaster said.

Bone-Chilling Temps Lift Spot Gas

Spot gas prices across most of the country rose Friday as weather conditions were expected to remain on the chilly side through early into the new week. A storm with heavy snow and ice was forecast to immobilize part of the South, although much drier air was expected to win the battle in the Upper Midwest through Sunday and the upper mid-Atlantic and New England early into the week, according to AccuWeather.

Forecasters expected the blockbuster snowstorm to slide eastward across North Carolina and southern Virginia and not make the northward crawl along the Atlantic coast. “This is not the type of storm where snow will continue to advance northward into the upper part of the mid-Atlantic and New England states,” AccuWeather senior meteorologist Brian Wimer said. “But, rather a westerly flow of dry air across much of the Northeastern states will limit the northward advance of the snow.”

While there was still a remote chance the storm would jog farther north near the coast, every indication pointed toward one-to-two feet of snow centered on western North Carolina, southwestern Virginia, southernmost West Virginia and far eastern Tennessee, the forecaster said.

Meanwhile, temperatures from Minneapolis and Chicago to Philadelphia, New York City and Boston should expect temperatures to average 5-10 degrees below normal, according to AccuWeather. Highs were forecast to range from the 20s across the northern tier to near 40 across the Ohio Valley and the upper part of the mid-Atlantic. Nighttime lows were forecast to range from the teens across the northern tier to the 20s in St. Louis and within a few degrees of 30 around Washington, DC, the firm said.

The frigid conditions on tap were expected to keep gas demand holding strong on Monday and Tuesday at 95.8 Bcf/d, according to Genscape Inc. Demand was then expected to quickly drop into Wednesday at 89.2 Bcf/d and then continue to shed an average 0.38 Bcf/d through the following seven days, the firm said.

Day/day changes to the six to 10-day weather forecast have removed about 0.3 Bcf/d from last Thursday’s demand forecast, according to Genscape. “Day-over-day changes to the longer-range 11- to 15-day forecast have shown even more warming than previously expected, resulting in the removal of about 1.6 Bcf/d of demand in the forecast,” senior natural gas analyst Rick Margolin said.

On the pricing front, some of the most pronounced increases were seen in Texas, where double-digit gains were the norm, especially in the eastern part of the state. Katy was up 15.5 cents to $4.455, while Atmos Zone 3 was up 31.5 cents to $4.32.

In the Midcontinent, ANR SW posted a substantial increase of more than 20 cents to reach $4.135, while most other pricing hubs rose less than a dime. Most points in Louisiana notched gains of 10-15 cents, although benchmark Henry Hub lagged behind with an increase of just 7 cents to $4.48.

Meanwhile, Tennessee Gas Pipeline (TGP) on Monday is scheduled to begin repairing the line covering at compressor station 524 in Jefferson County, LA. Maintenance would reduce operational capacity through the station to zero (traditionally 607 MMcf) until the repairs are completed, which is expected by next Saturday (Dec. 15).

Flows through the compressor station had averaged 30 MMcf/d over the last 30 days or so and have maxed at 88 MMcf, according to Genscape. Within the last three months, flows maxed out at 164 MMcf/d, demonstrating the volatility of gas flows through TGP’s southern compressor stations.

On the East Coast, spot gas markets were mixed as New England pricing hubs tumbled lower despite the projections for stronger demand there through the weekend. Demand in the region was at 3.7 Bcf/d as of Friday timely cycles, and was expected to add another 8 heating degree days on average by Saturday, according to Genscape.

Although current demand is roughly 800 MMcf/d short of peak deliverability, “we are firmly in the molecule bidding demand range, already causing daily swings to the tune of several dollars during elevated demand days,” natural gas analyst Josh Garcia said.

Meanwhile, Algonquin Gas Transmission declared an operational flow order in anticipation for the weekend’s increased demand.

Nevertheless, Algonquin Citygate spot gas plunged $1.39 to $7.77, with only a slightly smaller decline seen at Tenn Zone 6 200L.

Elsewhere in the Northeast, Transco Zone 6 NY jumped 77 cents to $5.435.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |