Shale Daily | E&P | NGI All News Access

Texas Upstream Jobs Slump in November, Ending Months of Gains

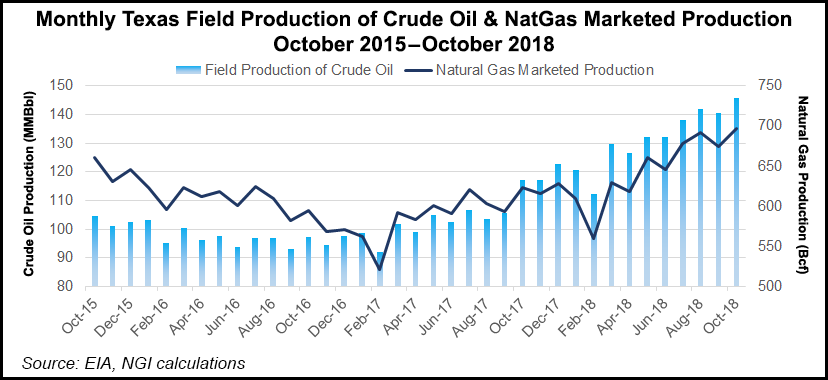

Upstream oil and natural gas employment in Texas, home to the Eagle Ford Shale, a chunk of the Haynesville Shale and most of the Permian Basin, is showing signs of wear, with jobs down by 500 in November from October, ending a 23-month consecutive gain.

According to the Texas Workforce Commission (TWC), 247,700 people were employed in the state’s upstream sector during November. Jobs had gained for almost two years straight, driven by sharp activity in the Permian, but they still haven’t attained the level they were in December 2014 of 308,900.

“We have seen tremendous growth in the oil and natural gas industry in Texas, including consistent job expansion, but growth is not guaranteed,” President Todd Staples of the Texas Oil & Gas Association (TXOGA) said Friday.

“The industry is vitally important to our state’s economy and national security, and innovation, efficiency and policies that encourage safe and responsible development are the keys to weathering fluctuations in the market.”

Upstream activity includes extraction and support activities for mining and excludes the refining, petrochemicals, fuels wholesaling, oilfield equipment manufacturing, pipelines and gas utilities sectors.

The Current Employment Statistics data series used to calculate employment figures by the TWC frequently is revised “for the most recent year or two of data, especially on a month-by-month basis,” according to TXOGA.

“It is possible that this 500-job variation could be revised in the next few months, either upward or downward,” Staples said.

Still, the general direction of oil and gas jobs — and enthusiasm by the energy industry — appears to be waning a bit.

According to the Dallas Fed Energy Survey of oil and gas executives in December, growth in energy sector activity slowed significantly in 4Q2018. The regional Federal Reserve Board survey measures conditions facing Eleventh District energy firms in Texas, southern New Mexico and northern Louisiana. Data were collected Dec. 12–20, and 167 energy firms responded, including 104 exploration and production (E&P) firms and 63 were oilfield services (OFS) firms.

Specifically for the labor market, the survey indexes “pointed to moderation in both employment and work hours growth” in the final three months, particularly for the OFS sector, while wage growth accelerated overall. The OFS employment index fell sequentially by almost half from 31.7 to 17.5, while the hours worked index for OFS also dropped, from 41.0 to 19.4.

“The declines were smaller for E&P firms as the employment index moved down from 17.4 to 11.5, and the hours worked index fell from 12.8 to 7.7,” Dallas Fed researchers said. “The aggregate wages and benefits index advanced from 23.5 to 32.9.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |