Shale Daily | E&P | NGI All News Access

Texas Upstream Jobs Climb for 21st Consecutive Month

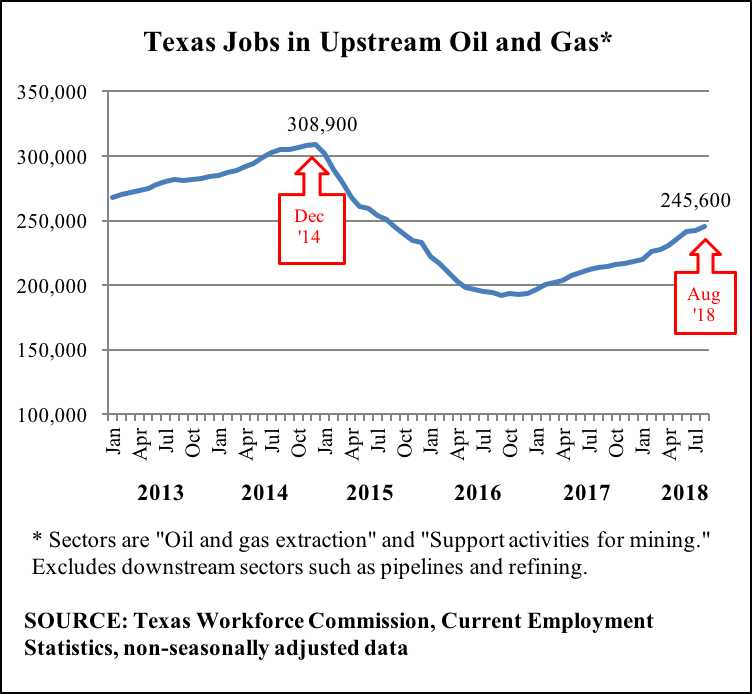

Texas oil and natural gas companies added 3,100 upstream jobs in August, marking the 21st consecutive month of job growth, the Texas Workforce Commission reported.

The state has recovered 46% of the energy sector jobs it lost from the high point for employment in December 2014 and the low point in September 2016, the Texas Oil & Gas Association (TXOGA) said. Since September 2016, the industry group said Texas upstream sector employment has risen by an estimated 53,200 jobs.

“The steady drumbeat of growth and investment in the Lone Star State is creating more jobs for more Texans,” said TXOGA President Todd Staples. “These are among the highest paying jobs in the state and the work these men and women do every day generates state and local tax revenue that fund our schools, build our roads and support our first responders.

“When the oil and natural gas industry does well, all Texans benefit,” Staples added.

Upstream activity includes oil and natural gas extraction and support activities for mining. The upstream sector excludes refining, petrochemicals, fuels wholesaling, oilfield equipment manufacturing, pipelines and gas utilities, which also may have contributed to Texas job growth.

The Federal Reserve Bank of Dallas this week published its 3Q2018 energy survey of 171 firms, including 10 exploration and production (E&P) companies and 61 were oilfield services (OFS) firms.

For the energy labor market, the indexes in 3Q2018 from 2Q2018 pointed to continued growth in employment and work hours.

“The rate of growth slowed, though, particularly for oilfield services,” researchers said. The employment index for OFS fell sharply from 44.1 to 31.7, while the worked index for services also fell to 41.9 from 50.8.

“Meanwhile, the employment index for E&P firms increased from 11.6 to 17.4, the highest level since the survey began. The aggregate wages and benefits index remained positive but fell from 27.9 to 23.5.”

The Permian Basin has most of the labor shortages, according to the survey. One E&P executive commenting for the survey cited constraints in skilled labor for commercial drivers, mechanics, electricians and welders, which likely will “limit service delivery, timing and quality, and thus negatively impact production growth.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |