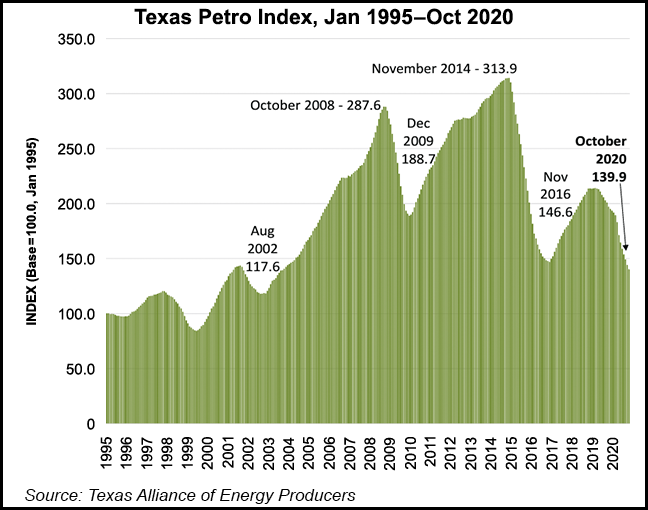

Routed by Covid-19, the Texas upstream oil and gas sector has lost more jobs this year than originally reported, according to a top industry group.

Using internal data and information provided by the Federal Reserve Bank of Dallas, aka Dallas Fed, workforce reductions in the state over the past year are steeper than first estimates, said the Texas Alliance of Energy Producers (TAEP).

“The headline industry employment data, which is only updated and revised once a year, indicates the loss of nearly 70,000 jobs from December 2018 through August 2020,” TAEP noted. “However, new data from the Dallas Fed and the Alliance suggests the employment loss is much deeper, with more than 80,000 jobs lost during the same period. In addition, nearly 60,000 jobs were lost from February to...