Texas Upstream Contracting on Volatile Commodity Prices, Slower Activity

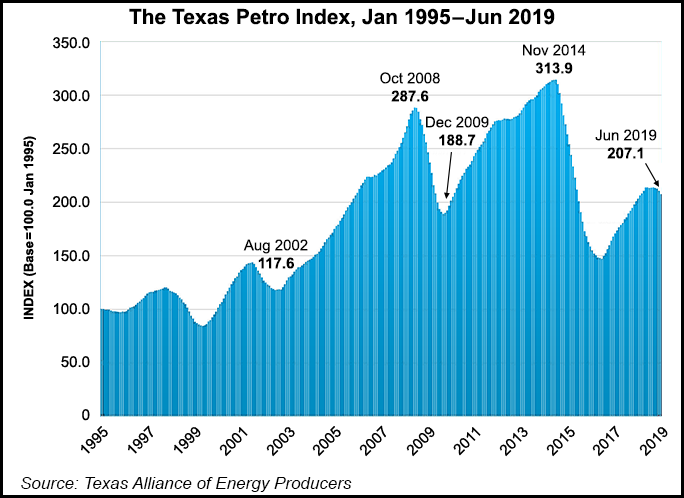

The Texas upstream oil and gas economy was in a “mild state of contraction” through the middle of the year, declining for six of the last eight months, according to the Texas Petro Index.

Creator of the index, petroleum economist Karr Ingham of the Texas Alliance of Energy Producers, said the state’s energy industry “achieved its cyclical peak in October 2018.” Since then, indicators have trended mostly south, including four consecutive months through June.

Oil and natural gas prices, the rig count, drilling permits issued and industry employment have lost ground since that October peak, said Ingham.

Two indicators that remained steady as of June were well completions and the value of statewide oil production. Oil and gas production also continues to increase.

The index, calculated using a comprehensive group of the state’s exploration and production factors, is keyed to 1995 as the base year, and in June 1995, the index stood at 98.4.

In June 2019, the index had climbed 2% higher year/year to 207.1, but it has lost 2.9% of its value since last October, Ingham said.

For example, last October the Texas rig count stood at 533, but as of July 26 it had fallen to 454. An estimated 2,200 jobs also have been lost since then; at the end of June the state employed about 224,600 people in the upstream sector.

The state’s industry today is facing “numerous headwinds to expansion” from sluggish oil prices and a gas supply glut, Ingham said. Throw in the imposition of steel tariffs, which has added direct industry upstream costs, as well as slowing trade, and the signs are visible statewide and globally.

The index peaked at 313.9 in November 2014, preceding the crash in oil prices, before plunging to 146.6 in November 2016.

Texas now is producing 42% of the nation’s crude, with the state’s Permian acreage alone contributing 25%, Ingham said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |