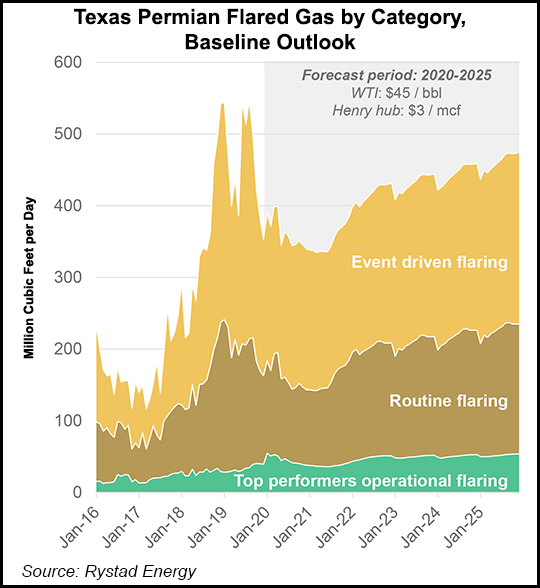

Natural gas flaring from the Texas portion of the Permian Basin is likely to increase in the coming years but the industry may be able to eliminate most of the routine emissions at little cost, according to a new analysis.

The Rystad Energy analysis, commissioned by the Environmental Defense Fund, found that the flaring is “persistent and likely to increase” as production rebounds. Eliminating the routine flaring, researchers said, could be a cost-effective measure with a nudge by the Railroad Commission of Texas (RRC).

“For example, if Texas were to adopt a 98% gas capture policy, Rystad found that about 84% of routine flaring volumes and 50% of total flared volumes in the basin could be mitigated without cost.

“Not only is routine flaring the cheapest type of...