Shale Daily | E&P | NGI All News Access

Texas Leads Gains as BHGE’s U.S. Rig Count Climbs by Four

The U.S. rig count grew by four to 1,067 for the week ended Friday (Oct. 19), driven by gains in oil drilling and featuring a sharp uptick in Texas, according to data from Baker Hughes, a GE Company (BHGE).

The United States added four oil-directed rigs and one natural gas-directed rig, offsetting the loss of one miscellaneous unit, according to BHGE. The domestic tally for the week outpaced its year-ago total by 154 rigs.

Three vertical units and two directional units returned to action, while one horizontal unit packed up shop. All of the net gains for the week occurred on land, as three rigs departed in the Gulf of Mexico.

In Canada, where producers have had to contend with disruptions because of an explosion earlier this month on Enbridge Inc.’s Westcoast pipeline, four rigs packed up, all oil-directed, putting the Canadian count at 191 (202 a year ago). That left the combined North American rig count flat for the week at 1,258, up from 1,115 in the year-ago period.

Among states, Texas was by far the biggest mover on the week, adding eight rigs to grow its tally to 540 (436 a year ago). There may have been some shuffling of rigs in the Permian Basin, as the other state underlying the U.S. onshore’s most active play — New Mexico — dropped two rigs to make it an even 100 versus 68 a year ago.

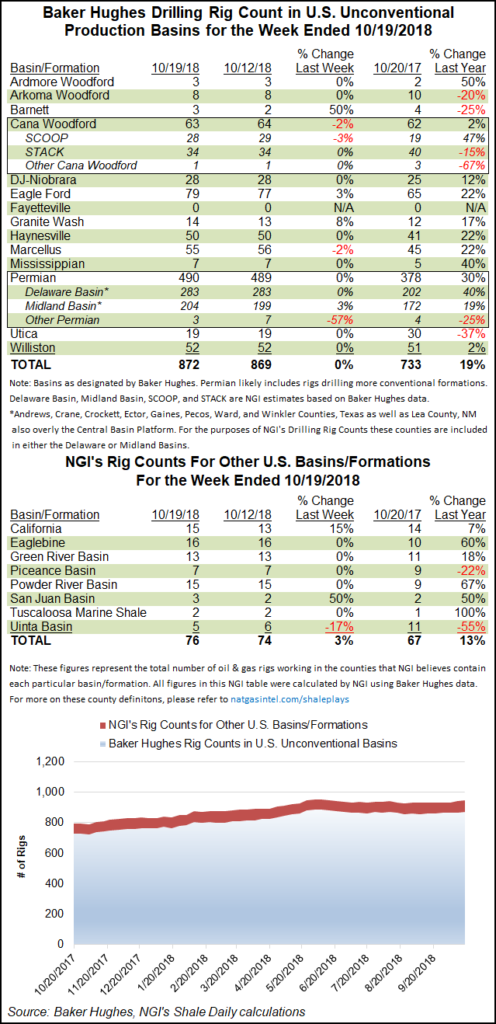

The Permian only posted a net gain of one rig for the week, growing its total to 490, easily outpacing the 378 rigs running in the play at this time last year. A more detailed breakout of BHGE data by NGI’s Shale Daily shows the Midland sub-basin picking up five rigs to offset a decline of four rigs in the “Other Permian” category.

Other notable Texas plays picked up gains on the week. The Eagle Ford Shale saw two rigs return to the patch, while the Barnett Shale added one. The Granite Wash, which straddles Texas and Oklahoma, also added one rig.

Also among plays, the Marcellus Shale and Cana Woodford each saw one rig depart, corresponding with the loss of one rig each from Pennsylvania and Oklahoma. Elsewhere among states, Alaska dropped two rigs for the week.

On Friday oilfield services company Schlumberger Ltd. helped usher in the start of 3Q2018 earnings season for the oil and gas industry.

The Permian may have gained on the week, but ongoing constraints appear to be taking their toll based on comments from Schlumberger CEO Paal Kibsgaard. Takeaway constraints in North America, particularly in the Permian, should be resolved within the next year to 18 months, but growing onshore challenges could hinder even the most optimistic projections for domestic oil production, he said during a conference call to discuss third quarter results.

“The dynamics of the pressure pumping market changed this quarter, and activity will likely continue to decline until the Permian takeaway capacity is resolved,” Kibsgaard said. “Accordingly, OneStim did not deploy additional hydraulic fracturing fleet capacity during the quarter.”

The company doesn’t expect to deploy more North American fracture crews through the end of the year either, he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |