Shale Daily | Coronavirus | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Texas E&P Industry Records Stinging Losses in April as Covid-19 Strips Jobs, Permitting and Production

Texas oil and gas activity suffered a bloodbath of sorts in April as the state began to register the full effects of the Covid-19 lockdowns, with upstream jobs tumbling to the largest monthly decline on record, the Texas Alliance of Energy Producers said Wednesday.

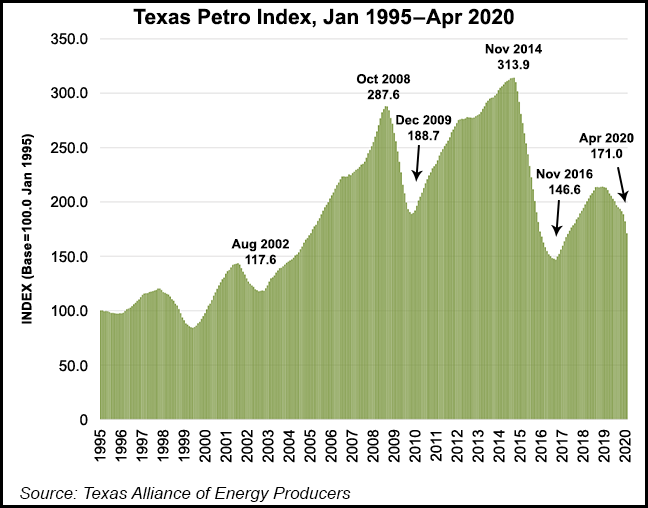

The statewide oil and gas association’s benchmark Texas Petro Index (TPI) fell to 172 in April from nearly 181.9 in March, the second largest monthly decline on record. The worst month/month decline was September to October 2015, when the TPI fell by 11 points during the 2014-2016 oil price collapse.

“The Texas upstream oil and gas economy was already in a state of decline when Covid-19 came along, with drops in the number of working rigs and industry employment, but the rate of decline has obviously accelerated sharply in March and April,” said the Alliance’s petroleum economist Karr Ingham, who created the TPI.

“The worst of the demand contraction is clearly behind us at this point, and hopefully we’ve seen the worst of the crude oil price environment in April as well. However, the fallout will continue for some time with more to come in the way of employment loss and idled production capacity, and the Texas Petro Index is certain to continue its decline in the coming months.”

The monthly TPI’s baseline of 100 compares January 1995 data, measuring the growth rates and cycles in the state’s upstream oil and gas economy. Indicators compared on a month/month and year/year basis include commodity prices, rig count, drilling permits, well completions and employment.

The April index of 172 was down year/year by 19.7%. The most recent cyclical peak was 213.8, registered in February 2019. The TPI since then through April has logged 14 straight monthly declines.

Texas oil output fell from March by an estimated 235,000 b/d, the largest monthly decline ever recorded, the Alliance said. In addition, only 456 original drilling permits were issued in April, “the lowest monthly level since at least January 1994,” the first year data collection began.

“Most components of the TPI declined from March to April, with the exception of oil and gas well completions and natural gas prices,” with completions “a lagging indicator that reflects pre-Covid drilling activity,” the Alliance noted. Many wells are drilled but remain uncompleted until producers are ready to tie them to sales.

In one bright spot, natural gas prices in Texas were higher in April versus March, thanks to stronger Permian Basin pricing “based on the prospect of lower associated gas production in the region” as fewer oil wells were drilled.

Otherwise, crude prices, the rig count, drilling permits, production volumes/value and direct industry employment recorded stinging losses. Estimated upstream job losses across the state in April were the highest in terms of the number and percent of jobs lost.

“The upstream oil and gas employment sector, reflecting jobs with operating and producing companies, oilfield service companies and drilling companies, shed an estimated 25,800 jobs from March to April, easily the largest monthly drop on record in terms of the number and percentage of jobs lost,” Ingham said.

Overall Texas oil and gas employment fell to a 10-year low in April. The monthly estimated upstream employment level of slightly under 180,000 jobs in April was at its lowest level since March 2010. Industry employment in Texas fell to a cyclical low of 181,600 jobs in September 2016 during the 2014-2016 industry downturn.

Of significance was the decline in oil production in April, the first sustained decline since the 2015-2016 crude price collapse, Ingham said.

“These numbers are very difficult to estimate in the near term, especially during a period of rapid transition from growth to decline,” he said. The decline in oil production “is important, because the discussion surrounding proration in Texas was whether the state should mandate production decreases by Texas operators as opposed to allowing the market to take its course. This makes it clear that market-imposed production declines in response to crashing demand and lower prices are rapidly adjusting Texas supply to current market conditions. Importantly, Texas operators will also need the flexibility to respond as prices recover.”

The Railroad Commission of Texas in early May defeated a motion that would have required all of the state’s oil and gas producers to curtail total oil output by 20%.

“In addition to shut-ins of current production, capital spending and new drilling has fallen sharply as well,” the Alliance noted. “The statewide rig count in April dropped by 111 rigs on average for the month compared to March and continues to decline.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |