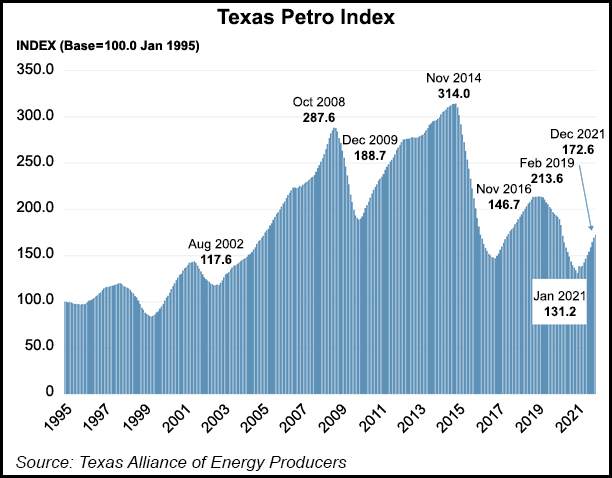

The Lone Star State’s exploration and production (E&P) economy enjoyed a year of recovery in 2021 on the heels of nearly two years of contraction, according to the latest Texas Petro Index (TPI).

The TPI, created by petroleum economist Karr Ingham of the Texas Alliance of Energy Producers (TAEP), measures growth rates and cycles of wellhead prices, rig counts, drilling permits, well completions, volume/value of production and E&P employment.

“The Texas upstream oil and gas industry endured a punishing two-year contraction, the second year of which was at the hands of Covid, which finally came to an end with the January 2021 trough in the Texas Petro Index,” said Ingham.

“The index has been steadily on the rise since then with higher prices, a growing rig count and a...