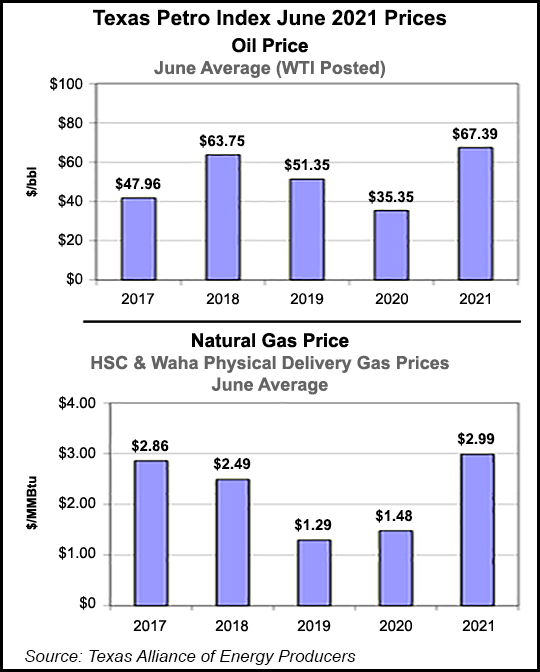

The upstream oil and natural gas economy in Texas is finally signaling a new cycle of expansion in activity following the double-barrel contraction in 2019 and 2020, according to economic indicators.

The Texas Petro Index (TPI), created and overseen by petroleum economist Karr Ingham of the Texas Alliance of Energy Producers, through June had increased for three straight months and four of the last five months.

The index improved to 147.2 in June from 143.1 in May. Still, the state remains in recovery mode, as the index was down by 7.2% from the June 2020 score of 158.6.

The index “reached its most recent cyclical peak of 213.6 in February 2019 and remains down by some 31% through June compared to that level,” the TPI researchers noted. “From peak to trough, the...