NGI The Weekly Gas Market Report | Coronavirus | Infrastructure | LNG | LNG Insight | NGI All News Access

Tellurian Slashes Spending, Confronts Turmoil in Global LNG Markets

Tellurian Inc. on Monday said it is feeling the squeeze of a global natural gas glut and has announced a cut in corporate spending as it works to sanction a massive liquefied natural gas (LNG) export terminal in Louisiana.

“Given current financial market conditions and increasing restrictions on travel caused by the onset of coronavirus, we are taking steps necessary to focus on preserving the value we have created at Tellurian and Driftwood LNG,” said CEO Meg Gentle.

The pre-revenue company said it would reduce corporate overhead to $6 million per month. It also said talks are underway with its lender to extend the maturity of a 2019 term loan due in May. The moves come only days after Chairman Charif Souki and Vice Chairman Martin Houston, who co-founded Tellurian in 2016, sold four million and 3.4 million shares, respectively.

According to Securities and Exchange Commission filings, the transactions were both an “involuntary sale effected by a lender to satisfy certain loan requirements.” The company’s stock plunged by double digits last week and opened on Monday at $2.22/share.

Last week, Tellurian said it extended negotiations for a key agreement to supply Petronet LNG Ltd. of India. The company pushed back the deadline to finalize a transaction with Petronet to May 31, two months later than the March 31 date set out in a September memorandum of understanding (MOU).

Under the MOU, India’s largest LNG importer would negotiate to purchase up to 5 million metric tons/year (mmty) of LNG from Driftwood, Tellurian’s massive 27.6 mmty export terminal planned for a site on the west bank of the Calcasieu River, south of Lake Charles, LA. Petronet would also make an equity investment in Driftwood Holdings. Driftwood was initially expected to reach a final investment decision (FID) last year.

Tellurian remains optimistic about its longer-term prospects, noting that low-cost U.S. natural gas would enable it to load LNG on the water at overseas prices of $3.00-4.00/MMBtu. The company said last week it expects to sanction Driftwood later this year and anticipates first LNG by 2023.

“We continue to see very strong growth in LNG demand from Asia in general, and India in particular, in spite of world conditions,” Gentle said. “We are highly confident that when travel restrictions are eased, we will be able to finalize several negotiations to complement the Petronet agreement and allow us to reach FID.”

More than 20 LNG projects are still pending in the United States alone, while supplies have steadily increased from other countries such as Australia and Russia. Demand has also been weakened by the coronavirus, which continues to spread across the globe.

“…The current uncertainty around global commodities demand and the recent coronavirus outbreak is making us increasingly cautious on FID progress,” analysts at Evercore ISI said last week of Tellurian’s project.

Cheniere Energy Inc., which Souki co-founded before being ousted as CEO, signaled a tighter global market during its year-end earnings call last week. Current CEO Jack Fusco said the low price environment and global oversupply have resulted in less customer appetite to sign long-term contracts. That’s also made it difficult for Cheniere to “continue to get our fair share of those contracts” and commercialize an expansion at Corpus Christi LNG in South Texas.

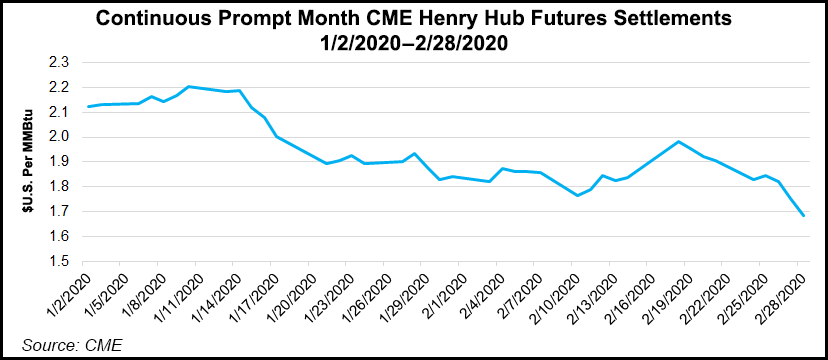

Global LNG prices have hit historic lows in recent weeks and the specter of U.S. LNG shut-ins looms as the forward curve through the summer and beyond shows the spread between the Gulf Coast and key markets in Northwest Europe and Northeast Asia in negative territory.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |