Regulatory | Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Tellurian Revamps Management, Cuts Jobs in Bid to Move Forward Driftwood LNG Project

In what could be seen as a Hail Mary pass to save its proposed Driftwood liquefied natural gas (LNG) export terminal, Tellurian Inc. has shuffled its executive leadership team and reportedly cut ties with about 70 employees.

Among the major moves is the promotion of investor relations chief Kian Granmayeh to CFO. Granmayeh, who previously worked in various roles at Apache Corp. before joining Tellurian in January 2019, replaces Antoine Lafargue, who is joining the marketing group as senior vice president (VP) of LNG Marketing.

Tellurian also named Amos Hochstein the new executive VP (EVP) of LNG Marketing. He joins COO Keith Teague, General Counsel Daniel Belhumeur, Tellurian Trading UK President Tarek Souki and Tellurian Production Co. President John Howie as EVP of Upstream on the executive leadership team.

CEO Meg Gentle acknowledged the current challenges in financial and energy markets and said the company is reducing costs and reorganizing “to make Tellurian resilient.

“We are redirecting resources to complete the marketing of the Driftwood LNG project, which is fully permitted and ready to begin construction.”

Tellurian has faced an uphill battle as it works to sanction the massive 27.6 million metric tons/year (mmty) export project. Earlier this month, the pre-revenue company said it would reduce corporate overhead to $6 million per month. It also said talks are underway with its lender to extend the maturity of a 2019 term loan due in May.

Gentle said Amos’ experience in LNG markets and expertise in negotiations brings together “key elements to complete our Driftwood partnership. With a broad background across the finance organization, Kian will be focused on capital discipline and refinancing our existing obligations to extend our liquidity.”

Chairman Charif Souki and Vice Chairman Martin Houston, who co-founded Tellurian in 2016, recently sold four million and 3.4 million shares, respectively, as part of an “involuntary sale effected by a lender to satisfy certain loan requirements.” The company’s stock has since plunged and traded below $1 on Monday.

Meanwhile, a trip to India last month that many market observers expected would result in a signed supply deal with Petronet LNG Ltd. instead ended with the two parties pushing back the deadline to finalize a transaction to May 31, two months later than the March 31 date set out in a September memorandum of understanding (MOU).

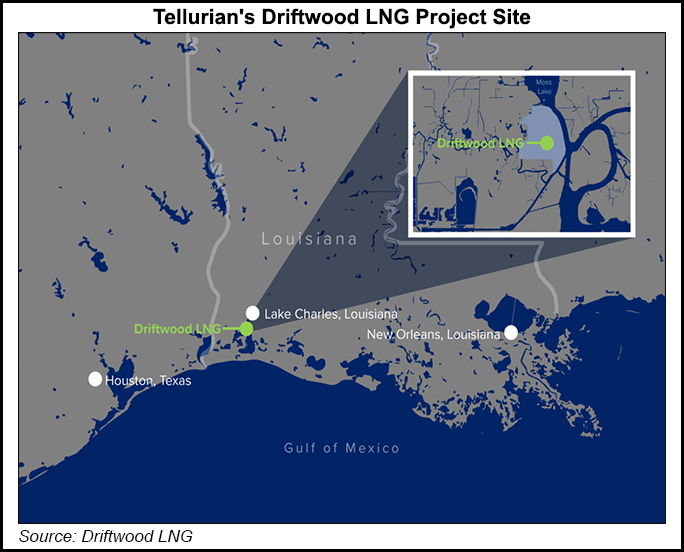

Under the MOU, India’s largest LNG importer would negotiate to purchase up to 5 mmty of LNG from Driftwood, which would be sited on the west bank of the Calcasieu River, south of Lake Charles, LA. Petronet would also make an equity investment in Driftwood Holdings. Driftwood initially was expected to reach a final investment decision last year, but it has recently indicated it could sanction the project later this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |