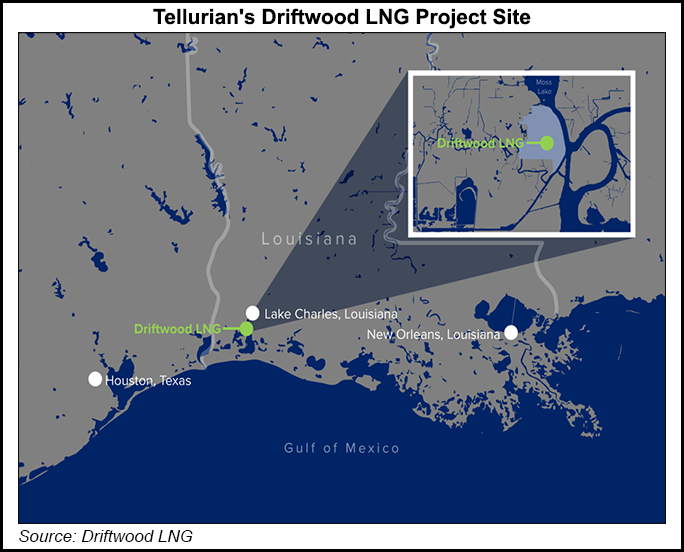

Tellurian Inc. said this week it has cut costs for the first phase of the proposed 27.6 million metric ton/year (mmty) Driftwood liquefied natural gas (LNG) export terminal as it works toward sanctioning the massive project in a weak global market.

The Houston-based operator indicated in an investor presentation on Wednesday that it would achieve a portion of the savings by deferring plans for three of the four pipelines proposed to feed the facilities.

Assuming a phase one contractor guarantee of 14.4 million mmty, and including upstream, owner, liquefaction and pipeline expenses, the company is now forecasting capital costs of $1,042/metric ton compared with the previous level of $1,473, for an all-in cost of $16.8 billion.

The latest cost projections only included...