Markets | NGI All News Access | NGI Data

Technical Issues Push CME to Revise Certain Energy Settlement Prices

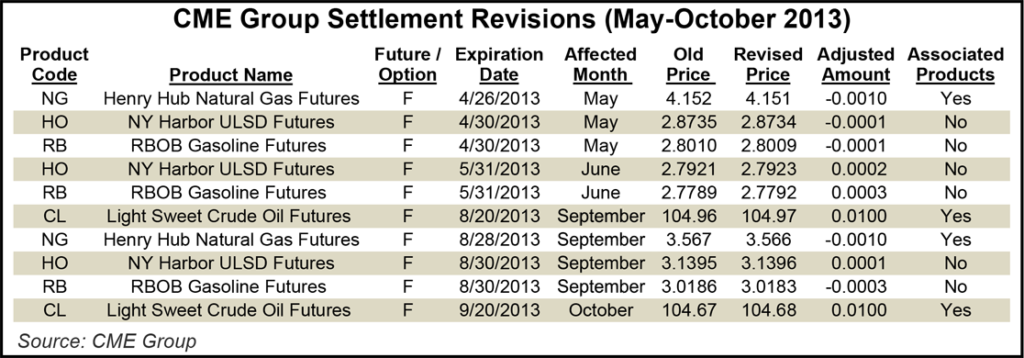

CME Group reported last week that due to a “technical issue” fractional changes have been made to the contract expiration prices of 10 Nymex energy products and related instruments settled between May and October 2013. This is the second time in less than a month that CME has had to issue an energy contract-related settlement revision.

The two natural gas products affected were the May and September 2013 Henry Hub Natural Gas Futures contracts. The price of May futures, which expired April 26, was revised downward from $4.152/MMBtu to $4.151/MMBtu, while the September contract, which expired August 28, was similarly revised down from $3.567/MMBtu to $3.566/MMBtu.

“Because of a technical issue some of the reported settlement prices were calculated incorrectly,” said Damon Leavell, senior director of Commodity Products for CME Group. “When we realized this, we tested our settlement programs to validate pricing, then updated those numbers.”

A number of associated natural gas basis and options products were also affected. The eight other major product adjustments occurred in NY Harbor ULSD Futures, RBOB Gasoline Futures and Light Sweet Crude Oil Futures. For a full list of relevant products and new settlement prices, visit https://www.cmegroup.com/market-data/files/energy-settlement-changes-2013-11-21.xls.

CME Group reportedly will make any account holders who were negatively affected by the revisions whole, and will not be asking anybody on the other end of those deals to make any sort of contribution. The exchange said that traders with questions could contact the CME Global Command Center in the U.S. at (312) 456-2391, in Europe at +44-20-7623-4708 or in Asia at +65-6223-1357.

CME Group’s previous revision occurred on Oct. 30 to the November 2013 natural gas futures contract expiration on Oct. 29 (see Daily GPI, Nov. 1). Without providing a reason, CME Group in its notice revised the November 2013 contract’s expiration from $3.496 to $3.497. “CME Clearing has contacted all affected firms and made the necessary adjustments,” the exchange said at the time.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |