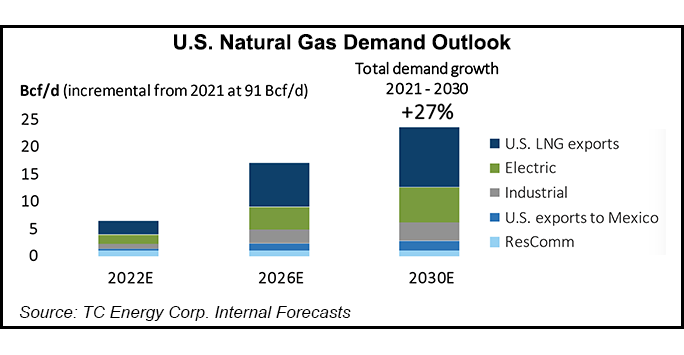

TC Energy Corp. is projecting U.S. natural gas demand to swell by over 27% by 2030 to about 115 Bcf/d versus 91 Bcf/d in 2021, with growth forecasted from LNG exports, power generation, industrial demand and pipeline exports to Mexico.

Although the expected growth is disproportionately led by liquefied natural gas exports, “nearly all sectors are expected to see some increase in throughput throughout the end of the decade,” TC’s Stanley Chapman III, vice president in charge of U.S. and Mexico natural gas pipelines, said during TC’s investor day in Toronto.

“On the supply side, there are plenty of resources in the ground to support growth,” Chapman said, including in the Permian Basin and Haynesville Shale, “and most importantly the Appalachian Basin.”

[Want...