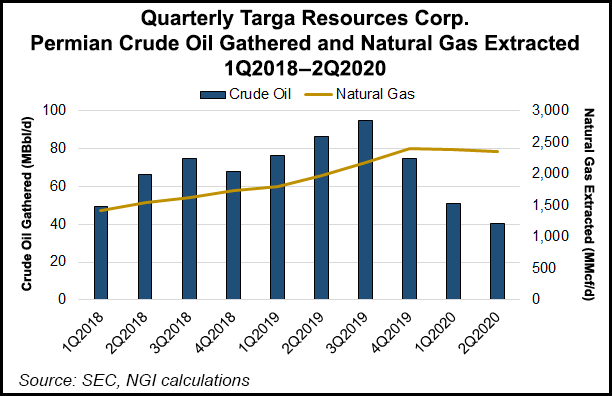

Targa Resources Corp.’s gathering and processing (G&P) volumes in the Permian Basin held steady in the second quarter, despite shut-ins, as producers remained active, with volume growth expected to the end of the year.

The Houston-based midstream operator noted strength in the Permian’s Midland sub-basin in West Texas, where natural gas inlet volumes advanced sequentially. Volumes across all the company’s Permian footprint declined only 1% sequentially, offsetting weakness elsewhere.

“This sets us up well” for the second half of the year “as we expect the benefit from stronger production across the Permian,” CEO Matt Meloy said on the quarterly earnings call Thursday.

“I think we benefit from just having a really large footprint in the Permian Midland,”...