Tanking LNG Demand Takes Center Stage in Natural Gas Futures Decline; Hefty Storage Build Expected

Natural gas futures continued to pull back Wednesday as liquefied natural gas demand (LNG) took another hit. With government storage data expected to produce a second consecutive triple-digit injection, the June Nymex gas futures contract settled 10.4 cents lower at $1.616. July fell 10.9 cents to $1.856.

Spot gas prices also retreated further amid the lack of significant heating or cooling demand across the Lower 48. NGI’s Spot Gas National Avg. dropped 10.5 cents to $1.480.

Lower gas prices during the spring season are to be expected, however, the magnitude of Wednesday’s losses in the futures market put the front-month contract within an arm’s reach of multi-decade lows. A rapid plunge in LNG feed gas volumes in the past few days, and projections for even softer demand over the coming months, drove the extensive sell-off.

“The loss of LNG is a big deal given how loose we have been already,” said Bespoke Weather Services.

In its latest Short-Term Energy Outlook, the Energy Information Administration (EIA) said that it expects LNG exports to average only 4.8 Bcf/d from July to September, roughly half of January peak levels.

Meanwhile, demand hasn’t recovered much yet as parts of the U.S. economy reopen, and any return is expected to be gradual, “not a rapid large jump,” according to Bespoke. The loose supply/demand balance keeps the market “rather easily” on pace to fill storage this fall, keeping alive a scenario which could lead to much lower prices yet at the front of the curve, it said.

The loose balance also has led to massive widening of forward spreads, Bespoke noted, with the October-January spread now more than 80 cents wide.

“Obviously, a lot can change between now and the end of summer, but until we see clear signs of significant tightening of balances, which requires a good portion of the economy reopening, it is just hard to find reasons to believe any sustainable rally will come at the front of the curve.” That doesn’t mean there won’t be short squeezes, similar to those seen in the past several weeks, and prices are getting near levels that have provided support so far, “but any rallies will get sold into until demand returns,” Bespoke said.

The EIA’s weekly storage inventory report, scheduled for 10:30 a.m. ET Thursday, may move the needle in the near term. Last week, the EIA reported a 109 Bcf injection that boosted inventories to 2,319 Bcf, 796 Bcf above year-ago levels and 395 Bcf above the five-year average. June prices fell 5.0 cents that day and then slipped another 7 cents on Friday.

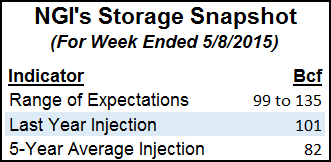

This week, a Bloomberg survey of eight market analysts showed injection estimates for the week ending May 8 ranging from 100 Bcf to 112 Bcf, with a median build of 107 Bcf. NGI, which nailed the EIA figure last week, projected a 113 Bcf injection.

This would compare to last year’s 100 Bcf build and the five-year average of 85 Bcf, according to EIA.

Spot gas prices posted big drops on both U.S. coasts on Wednesday as lackluster demand failed to inspire any rebound across Lower 48 markets.

NatGasWeather said that cool conditions were forecast to linger across the Midwest and Northeast for another day, while conditions remain “perfect” from Texas to the Southeast. Weather systems with showers were expected to push into the West over the next week, while temperatures were forecast to warm across the northern United States, making for “very light demand” from Chicago to New York City.

In the Northeast, spot gas prices at Transco Zone 6 non-NY dropped 15.5 cents day/day to average $1.225. The sharp move lower was in line with other markets in the region, as well as those farther upstream in Appalachia. Dominion South cash was down 17.0 cents to $1.180.

Spot gas markets across the Southeast, Louisiana and into the Midcontinent also declined, but losses were capped at around 10.0 cents at the majority of pricing hubs.

The extensive sell-off occurred even as Gulf South Pipeline is set to kick off scheduled maintenance Thursday at the Mira compressor station. The work, to continue through Saturday, is expected to impact Gulf Crossing Paris Throughput Scheduling Group’s operational capacity by as much as 244 MMcf/d, curtailing nearly 200 MMcf/d of Gulf Crossing flows to Louisiana based on this week’s flow data, according to Genscape Inc.

“Over the prior 14 days, the Gulf Crossing Paris Throughput Scheduling Group has averaged flows of 1.57 Bcf/d, maintaining little (around 100 MMcf/d) of operationally available capacity,” said Genscape analyst Preston Fussee-Durham. “Flow impacts are likely to materialize as a result of this scheduled event.”

Nearby, maintenance at the Hall Summit compressor station in northwestern Louisiana has resulted in receipt impacts of nearly 170 MMcf/d, which are likely to be sustained until completion on Friday.

“Combined, the overlap of these maintenance events could result in short-lived supply disruptions on Gulf South later this week, but remain in the shadow of a larger LNG pushback within the Gulf Coast region,” Fussee-Durham said.

Out West, spot gas prices in the Rockies fell around 10 cents or so across the region, while slightly steeper losses occurred in California. SoCal Citygate cash plunged 17.5 cents to $1.695.

Genscape noted that Southern California Gas (SoCalGas) storage inventories are trending above three-year averages but are still well below their range for this time of year relative to levels seen before the 2015-2016 Aliso Canyon storage field leak.

“SoCalGas’ storage inventory has risen to nearly 60 Bcf this week, its highest level for this time of year since 2016,” said Genscape analyst Joseph Bernardi. “This past winter’s inventories trended at or near the top of the three-year range all season. And without a major prolonged spell of late winter demand in February-March, as happened in 2019, SoCalGas exited the winter with end-of-season inventories above 50 Bcf, the first time that has happened in four years. Its storage levels were still well below the five-year end-of-season average from before the Aliso Canyon leak, though, at 67 Bcf.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |