NGI Mexico GPI | E&P | NGI All News Access

Talos Looking at Late 2020 FID on Zama Discovery Offshore Mexico

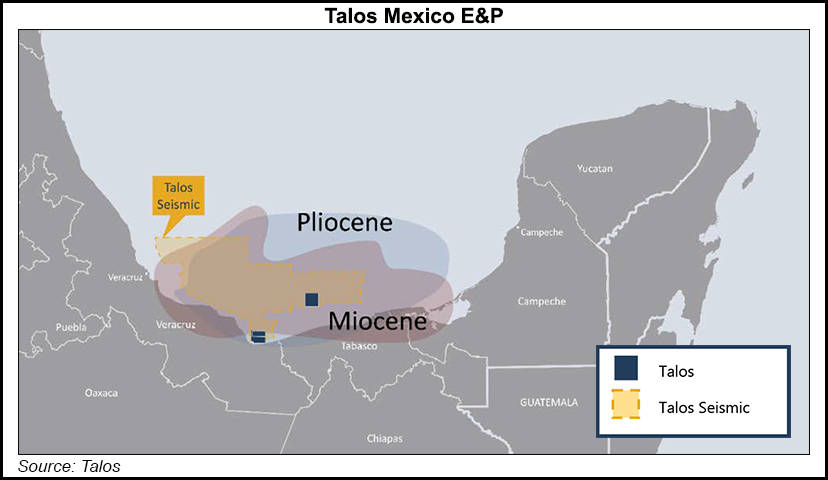

Houston-based exploration and production company Talos Energy Inc. expects a final investment decision (FID) toward the end of the year on its Zama discovery offshore Mexico, pending clarification on the shared nature of the field with Mexican state company Petróleos Mexicanos (Pemex).

On Thursday, Mexico upstream regulator Comisión Nacional de Hidrocarburos (CNH) found that there was connectivity between Zama and the neighboring block controlled by Pemex, which means the process will now move on to the Mexican energy ministry and parallel discussions with Pemex.

CEO Tim Duncan said this next process should take “anywhere from between three and six months,” pushing back FID to the end of the year.

“We’ve always said it’s two and a half years to first oil once we get the FID,” he said, adding that because of the coronavirus, permitting and other work with Mexican state agencies have slowed.

Zama is considered to be one of the largest oil finds in Mexico by a private sector operator. In January, Talos announced that Netherland, Sewell & Associates, Inc. (NSAI) concluded a contingent resource estimate for Zama. NSAI’s best estimate of Zama’s 2C, or contingent gross recoverable resource, is about 670 million boe, in line with a previously guided range by Talos of 400-800 million boe.

Pemex CEO Octavio Romero Oropeza sparked controversy earlier this year when he said the state oil company holds the majority of the resources in Zama and should be the operator. Duncan said the ongoing discussions don’t have to do with Pemex being the neighbor on the block, but rather the extension of the reservoir.

“We’ve entered this phase partly because this discovery is maybe even bigger than we thought,” Duncan said.

Talos holds a 35% operating interest in the consortium that operates offshore Block 7, which was awarded through the Round 1.1 bidding process conducted by CNH in 2015. The remaining stakes are held by Sierra Oil & Gas, Wintershall DEA Co. (40%), and Premier Oil plc (25%), which is seeking to sell its stake.

During the second quarter, Talos, which also has producing assets in the U.S. Gulf of Mexico, expects production curtailments of 12,500-13,300 boe/d as a result of maintenance and the current commodity price environment. Talos has so far not experienced production shut-ins resulting from midstream or storage capacity constraints, executives said.

Talos also plans to cut a further $30 million of operating and capital costs for 2020, in addition to the $170 million of reductions announced in March for capital, operating and general/administrative expenses.

“We have reduced our 2020 capital program by approximately 40% and our operating and overhead cost structure by approximately 15% compared to pro forma 2019 levels, and we expect those levels to continue to improve throughout the year,” Duncan said.

Talos produced 58,100 boe/d in the first quarter, of which 70% was oil and 78% liquids. March production averaged 70,300 boe/d.

Talos has implemented measures to ensure the health and safety of its employees and the safe continuation of operations in light of the coronavirus. The company has had zero confirmed cases among its portfolio of 27 operated, manned platforms. Additional screening processes for offshore workers include daily temperature monitoring and Talos has also required office workers to work from home until restrictions are lifted.

Talos reported net income of $157 million ($2.71/share) in the first quarter, compared with a loss of $109 million (minus $2.02) in the same period last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |