Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Tallgrass Gains 75% Stake in REX in $440M Deal with Sempra

A unit of San Diego-based Sempra Energy has agreed to sell its 25% stake in the Rockies Express Pipeline (REX) to Tallgrass Development LP for $440 million in cash, which would hand Tallgrass a three-quarter stake in the massive natural gas system.

Sempra U.S. Gas & Power unit said late Tuesday it would sell its interest to a unit of Tallgrass, which already owned 50% of REX. The agreement is subject to customary closing conditions and a right of first refusal.

Sempra U.S. Gas CEO Patti Wagner said the company’s minority stake in REX was no longer “consistent with our long-term growth strategy.” REX has been “an important part of the country’s natural gas pipeline system,” but that with changing market conditions, Sempra can “more productively redeploy the proceeds from the REX sale into long-term growth opportunities that better meet our strategy and risk profile.”

The transaction is expected to close by the end of June.

As part of the sale, Sempra would permanently release remaining uncontracted capacity that it holds on REX that it had been releasing on an interim basis, resulting in an earnings charge in 2Q2016 of $100-120 million. The acceleration of losses otherwise would have been realized over the full contract term running through November 2019.

“It is expected that the approximately $27 million after-tax loss resulting from the permanent release of REX capacity will be excluded from Sempra’s adjusted 2016 earnings guidance,” a Sempra spokesperson said.

Sempra’s REX profits estimated for March through December are expected to be reduced by about $60 million, and they were forecast to be “immaterial” beginning in 2020, said CFO Joseph Householder. Redeploying the sale proceeds is expected to mitigate the loss and “increase our long-term earnings profile,” he said.

Sempra plans to adjust its 2016 earnings guidance by the May 24 annual analyst conference.

Four years ago, Sempra took a significant hit to its 2Q2012 profits related to its REX stake, but executives at the time still called it a “significant” asset long term because of its potential role in moving natural gas bidirectionally from the developing parts of the Utica and Marcellus shales (see Daily GPI, Aug. 8, 2012).

Tallgrass bought Kinder Morgan Inc.’s REX stake in 2012 (see Daily GPI, Nov. 14, 2012). A ConocoPhillips unit has the remaining 25% interest.

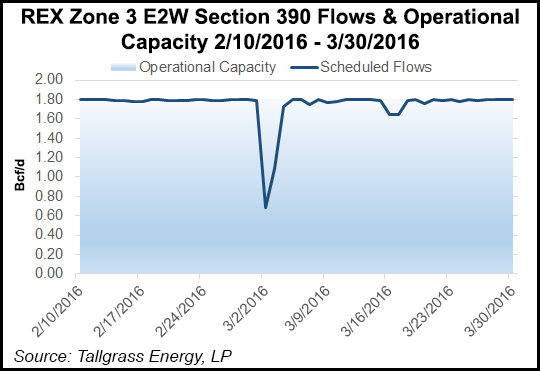

In order to more closely follow flows in the region on REX, NGI has developed the Rockies Express Zone 3 Tracker, which is updated daily and will be adding additional analytics on the flows out of the Appalachian Basin in the near future.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |