West Virginia tax collections continued falling through the first three months of the fiscal year in a trend that state officials again attributed to weak commodity prices, which have negatively impacted the oil and natural gas industry.

Tag / West Virginia

SubscribeWest Virginia

Articles from West Virginia

West Virginia’s NatGas Industry Donates $425,000 for Flood Victims

West Virginia’s natural gas industry has pitched in to help with recovery efforts after devastating flooding last week damaged homes and claimed the lives of as many as 23 people in the state (see Shale Daily, June 28).

Brief — WV Budget

West Virginia’s Republican-controlled legislature concluded this year’s 60-day regular session on Saturday without passing a balanced budget. Democratic Gov.Earl Ray Tomblin indicated he would likely have to call lawmakers back for a special session to resolve the impasse. The state’s general revenue budget has grown rapidly over the last decade, and lawmakers are gridlocked over how to balance the $4.3 billion budget and plug a nearly $400 million deficit. The state Senate shelved a House-crafted budget over the weekend that would have relied on $72 million in spending cuts for state agencies, while the House has rejected a Senate proposal that would raise $139 million in tax increases on tobacco products, among other things. The state has long relied on its coal and natural gas severance taxes to balance its budget, but the commodities downturn is now straining its finances. Overall severance tax collections rose by 2% through the first nine months of fiscal year (FY) 2015 but fell 31% through the final three months, reflecting coal’s ongoing downturn and a drop in oil and gas prices. The state has projected that FY 2016 severance tax collections could fall nearly $192 million short of projections (see Shale Daily,Oct. 7, 2015). The House last week shelved a bill passed by the Senate that would have lowered the coal and gas severance taxes (see Shale Daily,March 8).

Briefs — West Virginia, Ohio

The West Virginia House of Delegates has officially abandoned legislation that would have significantly cut the state’s 5% oil, natural gas and coal severance tax rate. House leaders said that they would instead study the cuts over the next year. The West Virginia Senate passed SB 705 in early March. It would have lowered the severance tax rate to 4% by July 2017 and to 3% in July 2018. The state tax department estimated that the cuts would have cost the state up to $129 million in 2018. Sources had told NGI’s Shale Daily prior to the House’s announcement that the bill stood only a small chance of being passed (see Shale Daily,March 8). Democratic Gov. Earl Ray Tomblin also indicated that he would have vetoed the bill.

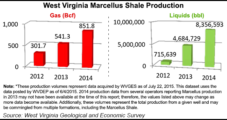

West Virginia NatGas Output Shows Dramatic Gain to 1 Tcf in 2014; More on the Way

Liquids and natural gas production in West Virginia took a major leap forward in 2014, the latest year for which data is available, with the Marcellus Shale driving gas volumes to more than 1 Tcf for the first time in the state.

West Virginia Senate Passes Bill to Lower Oil/Gas Severance Tax Rate

The West Virginia Senate passed a bill on Wednesday that would sharply reduce the state’s severance tax rate on oil, natural gas and coal production.

West Virginia Senate Votes Down Pipeline Survey Bill

The West Virginia Senate on Monday rejected a bill that would have given natural gas companies the right to survey on private property without the owner’s consent.

Brief — West Virginia Legislature

The West Virginia Senate has passed two bills to benefit the oil and gas industry. SB 508, which would clarify the language that defines a private nuisance, passed 20-12 and has been sent to the state House judiciary committee (see Shale Daily,Feb. 18). It would make it more difficult for residents to file lawsuits against producers and other businesses by requiring them to prove physical property damage or a bodily injury claim. SB 565, which would allow drillers to construct access roads and well pads before submitting plans and receiving a permit, passed the chamber 31-1 and has been sent to the House energy committee. Operators could start work without submitting engineering plans or receiving a permit from the state, but they would still be required to do so before drilling any wells. The legislature’s 60-day 2016 legislative session adjourns March 12.

MarkWest Continues Response to 3,000 Gallon Chemical Spill in West Virginia

MarkWest Energy Partners LP continued to lead environmental remediation efforts in Wetzel County, WV, on Tuesday, three days after the company discovered that 3,000 gallons of chemicals had leaked from its Mobley Processing Facility.

EQT Grows Bullish On Utica, Possibly Eclipsing Core Marcellus Assets

EQT Corp. on Thursday continued to tout its deep, dry Utica Shale prospects in Southwest Pennsylvania and Northern West Virginia, and said for the first time some of the formation could meet or exceed the performance of its core Marcellus Shale assets.