After 90 days of production, EV Energy Partners LP’s closely watched Nettles 3H well in Tuscarawas County, OH, which was stimulated with a mixture of liquid butane and mineral oil instead of water, has failed to meet the company’s expectations.

Volatile

Articles from Volatile

EVEP’s Waterless Utica Frack Fails to Unlock Volatile Oil

After 90 days of production, EV Energy Partners LP's closely watched Nettles 3H well in Tuscarawas County, OH, which was stimulated with a mixture of liquid butane and mineral oil instead of water, has failed to meet the company's expectations.

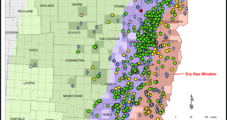

Marcellus Gas Wells — Dry or Wet — Competing with Bakken Economics

Given current commodity prices, natural gas wells drilled in the Marcellus Shale — wet or dry — compete favorably with marginal Bakken Shale oil wells, but that’s the only gas play in the U.S. onshore that today can compete with Bakken oil well economics, according to an analysis by Barclays Capital.

Midwest Ripped by Cold, Snow, Yet Cash, Futures Ease

Thanks to volatile Northeast gas prices, the national average for physical natural gas traded Thursday for Friday delivery dropped nearly 50 cents.

Midwest Gains Pace Weather-Driven Advance; Futures Rise

Physical natural gas prices at most points across the country rose about a dime Tuesday, but if the highly volatile Northeast is added to the mix, the overall change is a loss of about 3 cents.

Big New England Losses Overshadow Modest Market Declines

Physical natural gas prices Wednesday eased a couple of pennies in an overall broad decline. However, if volatile New England points on pipelines such as Iroquois, Algonquin, and portions of Tennessee are factored in, the decline is 27 cents. No more than a handful of locations were able to post gains. At the close of futures trading March had added 7.6 cents to $3.306 and April was up by 7.5 cents to $3.371. March crude oil slipped 50 cents to $97.01/bbl.

Northeast Storm-Driven Surge Masks Overall Weakness; Futures Slide

Physical natural gas prices Friday rose an average 79 cents to $4.92, but if the highly volatile and constrained New England points are removed from the figures, the average was a loss of 2 cents to $3.58.

Northeast Tumbles, East Weakens, and California Steady

Spot natural gas prices on average fell 37 cents Monday, but if volatile New England pipes such as Algonquin, Iroquois and portions of Tennessee are factored out, the decline was about 3 cents.

Weather, Storage Lift Cash, Futures; March Adds Almost 8 Cents

Physical gas prices Wednesday gained on average by 11 cents overall, but if the volatile East is included, the rise was just under 18 cents. Gains were widespread with only a handful of points recording losses.

EIA: Pipe Constraints Creating ‘Volatile’ New England Prices

Natural gas pipeline constraints, high international prices and declining production in eastern Canada could all combine to create sometimes volatile New England gas and power prices this winter, according to the Energy Information Administration (EIA).