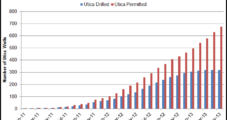

Although investors were disappointed by the Utica Shale production figures released last week by the Ohio Department of Natural Resources (ODNR), a surge in production should be at hand in the play as infrastructure comes online, according to an analysis from RBN Energy LLC.

Tag / Unfortunately

SubscribeUnfortunately

Articles from Unfortunately

Marcellus Could Spark Life into Old Oil Complex, Says IHS

Marcellus Shale reserves may spark life into a shuttered, 110-year-old oil refinery complex south of Philadelphia that once supported nearly 500 jobs, according to IHS Inc. researchers.

Groups to Obama: Halt Fracking by ‘Any Legal Means’

A coalition of 69 environmental groups has urged President Obama to “employ any legal means” to halt hydraulic fracturing (fracking) and suggested a federal moratorium until further environmental studies of the practice are completed.

Mixed Pricing Favors Downside; Northeast Dives

With a few instances of flat to modestly higher numbers sprinkled here and there, most of the cash market recorded small losses Friday in a muted reversal of the advances that had thoroughly dominated trading earlier last week. A large majority of the drops were in single digits. Northeast citygates, having much greater heights from which to fall, tended to see all of the larger declines ranging from a little more than a dime to as much as $1.30 or so.

Industry Veteran: Broken Market Can Be Fixed

Reversing the old saying, “if it ain’t broke, don’t fix it,” Ben Schlesinger of Benjamin Schlesinger and Associates said last week that unfortunately the energy market is broken and desperately needs to be fixed soon.

Schlesinger: Broken Market Can Be Fixed

Reversing the old saying, “if it ain’t broke, don’t fix it,” Ben Schlesinger of Benjamin Schlesinger and Associates said that unfortunately the energy market is broken and desperately needs to be fixed soon.

July Unloads 34.9 Cents, Drops Below $4

Futures succumbed to another major technical correctionyesterday as the July contract gapped 2.5 cents lower at the openand dropped a dime early on before plummeting after the AGA gasstorage report came out at 2 p.m. At the end of the regular tradingsession, July was down 34.9 cents, August had dropped 35.1 centsand September was off 33.1 cents. The July contract had a 39-centrange for the day, trading as high as $4.335 and as low as $3.930.