Gastar Exploration Ltd. is selling about 76,000 net acres in Kingfisher and Canadian counties in Oklahoma for $62 million and also agreed to swap acreage with the undisclosed buyer so that both might concentrate their positions, the company said Tuesday.

Tag / Undisclosed

SubscribeUndisclosed

Articles from Undisclosed

Anadarko Takes New Partner in Heidelberg Prospect

Anadarko Petroleum Corp. has entered into a carried-interest arrangement with an undisclosed party for a stake in the prospective Heidelberg development project in the deepwater Gulf of Mexico.

Devon Energy Selling Some TMS Acreage

Devon Energy Corp. is selling Tuscaloosa Marine Shale (TMS) assets in Louisiana and Mississippi, offering about 297,000 net acres (nearly 95% undeveloped) within the unconventional oil play, and production of about 600 b/d, according to the offering by Scotia Waterous (USA) Inc.

Industry Brief

Penn Virginia Corp.’s 40% working interest partner in its Lavaca County, TX, Eagle Ford Shale acreage has elected to go “nonconsent” on the last 17 initial unit wells on the acreage. Penn Virginia said it will seek a partner to acquire the 40% working interest. Of 17 initial unit wells, seven have been drilled, two are being drilled and eight remain to be drilled, the company said. The current working interest partner will have no participatory rights in any subsequent wells drilled in the unit. As a result, Penn Virginia’s net Eagle Ford acreage in Lavaca County will increase from about 9,200 acres to about 13,400 acres upon the drilling of all of the initial unit wells. “We expect that each of the drilling units will support up to an additional four primary development wells after the initial well,” Penn Virginia said. “To date, our Lavaca County wells have generally met or exceeded expectations with average reserves of approximately 500,000 boe and attractive economics.” In October, Penn Virginia acquired about 4,100 net Eagle Ford acres in Gonzales and Lavaca counties for about $10 million. Other nonoperated working interest owners were expected to acquire some of the acreage (see Shale Daily, Oct. 4). One year ago, the company said it was exploring the Eagle Ford with an undisclosed “major oil and gas company” (see Shale Daily, Dec. 21, 2011).

Carrizo Sells Northern Utica Assets, Eyes Additional Southern Acreage

Carrizo Oil & Gas Inc. announced Monday that it had closed on the sale of a majority of its leasehold in the northern Utica Shale to an undisclosed buyer for $43 million in cash.

Williams Expands Canadian NGL Operations with Oilsands Agreement

Williams on Wednesday clinched a long-term natural gas processing agreement with an undisclosed Canadian oilsands producer that would significantly expand the Tulsa operator’s liquids and transportation business.

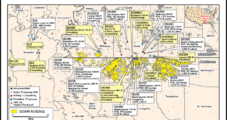

Atlas Pipeline Completes Woodford Expansion, Begins Midcon Buildout

Atlas Pipeline Partners LP (APL) has completed a 60 MMcf/d expansion of its Velma system in the Woodford Shale of Oklahoma, increasing capacity to 160 MMcf/d.

MDU Pays $66M for Stake in Whiting’s Bakken Midstream Assets

MDU Resources Group Inc., which has five rigs in operation in the Bakken Shale and holds 124,000 net leasehold acres in the play, said subsidiary Bitter Creek Pipelines LLC has paid $66 million for a 50% interest in Whiting Oil and Gas Corp.’s natural gas and oil midstream assets near Belfield, ND.

Industry Briefs

Marathon Oil Corp. has agreed to sell nearly all of its natural gas properties in the state for an undisclosed sum to Hilcorp Alaska LLC, a unit of privately held Hilcorp Energy Co. The sale includes an estimated 17 million boe net of proved reserves in 10 fields in which Marathon holds interests in the Cook Inlet. Gas operations include the McArthur River, Ninilchik, Cannery Loop and Kenai Gas units, as well as Beaver Creek, which is an oil and gas development within the Kenai National Wildlife Refuge. The sales package also includes natural gas storage and gas pipeline transmission systems. Last year Marathon’s Alaska net production averaged 93 MMcf/d of gas and 112 b/d of oil. The company also had about 12.5 Bcf in storage at the end of 2011. The transaction, with an effective date of Jan. 1, 2012, is set to be completed this fall. Not to be sold is Marathon’s onshore drilling rig, which is being marketed separately.

Marathon Selling Alaska Natgas Assets

Marathon Oil Corp., an Alaska operator for more than 55 years, late Monday agreed to sell nearly all of its natural gas properties in the state for an undisclosed sum to a unit of privately held heavyweight Hilcorp Energy Co.