Natural gas futures rallied sharply early Thursday as analysts pointed to stronger overseas prices and a less bearish domestic weather outlook. The November Nymex contract was up 20.9 cents to $5.799/MMBtu at around 8:50 a.m. ET. In terms of recent weather model runs, EBW Analytics Group analysts early Thursday observed an additional 8.4 Bcf of…

TTF

Articles from TTF

ICE Reports Record Volume in September on European Natural Gas Trades

Intercontinental Exchange Inc. (ICE) is logging more record trading activity on its European natural gas futures contracts amid increasing volatility in the global market. An unprecedented 5.5 million Dutch Title Transfer Facility (TTF) futures and options were traded in September, 37% higher than the previous monthly record set in January, ICE said. The exchange also…

‘Dangerous Trade’ for NatGas Amid Overseas Volatility; Futures Slide Ahead of EIA Print

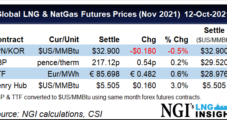

Natural gas futures extended their losses in early trading Thursday as the market braced for a potential triple-digit inventory build from the latest weekly government storage report. After plunging 63.7 cents in the previous session, the November Nymex contract had shed another 12.2 cents to fall to $5.553/MMBtu at around 8:45 a.m. ET. Surveys ahead…

Volatile Natural Gas Futures Pare Gains Early as Euro Prices Seen Influencing Henry Hub

In another show of volatility, natural gas futures pared their recent gains in early trading Wednesday, slashing double digits off of the previous session’s rally as analysts continued to note an exceptionally mild October forecast. After soaring 54.6 cents higher in Tuesday’s session, the November Nymex contract was down 17.7 cents to $6.135/MMBtu at around…

Henry Hub Seen Following Euro Prices Higher as Natural Gas Futures Surge Above $6 Early

Natural gas futures advanced in early trading Tuesday, leading analysts to look to European price trends as the catalyst amid signs of a loosening supply/demand balance domestically. The November Nymex contract had surged 28.4 cents higher to $6.050/MMBtu as of around 8:50 a.m. ET. The major weather models added a “very minor” amount of total…

Natural Gas Futures ‘Pressing Higher’ on Euro Gains Despite Mild Weather Domestically

Natural gas futures recovered most of their losses from late last week in early trading Monday, rising double digits as analysts continued to see indications of domestic prices responding to conditions in overseas markets. After settling 24.8-cents lower on Friday, the November Nymex contract was up 21.7 cents to $5.836/MMBtu at around 8:45 a.m. ET.…

Russia Pressured by IEA to Ease Europe’s Natural Gas Crisis

The International Energy Agency (IEA) said Tuesday market fundamentals rather than the energy transition are to blame for record natural gas prices in Europe, but it stressed that Russia could be doing more to help ease the crisis. European natural gas prices increased by nearly 16% Monday, with the front-month UK benchmark finishing close to…

Tropical Storm Nicholas Shuts Down Freeport LNG, Threatens Other U.S. Export Terminals — LNG Recap

Tropical Storm Nicholas, which moved onshore Texas early Tuesday, has temporarily shut down the Freeport liquefied natural gas (LNG) terminal south of Houston, and is projected to sweep over all of the Gulf Coast’s major export facilities in the coming days. The storm’s turn toward Louisiana may threaten exports at a time when the global…

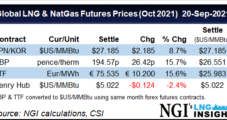

Natural Gas Futures Extend Rally Early as Nicholas Seen Bearing Down on Houston

Tight domestic balances, strength in global prices and a tropical cyclone churning along the coast of Texas gave traders plenty to ponder early Tuesday as natural gas futures continued their ascent. After rallying 29.3 cents in the previous session, the October Nymex contract was up another 10.3 cents to $5.334/MMBtu at around 8:50 a.m. ET.…

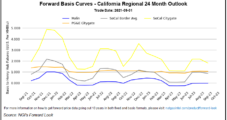

Natural Gas Forward Prices Explode as Ida Adds to ‘Precarious’ Storage Outlook

Though long gone from the Gulf Coast, Hurricane Ida’s devastation continued across the eastern United States ahead of the Labor Day weekend, wiping out significant production and causing widespread power outages along the way. Supply’s slow expected recovery fueled bullish momentum across natural gas forward curves for the trading period ending Sept. 1, resulting in…