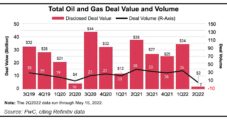

Higher commodity prices have whetted investors’ appetite for more natural gas and oil deals, and the pace of activity should pick up for the rest of this year, PwC predicted in a recent midyear report. “Private equity deals are on pace for another record year as traditional oil and gas investments become attractive once again,”…

Tag / Transactions

SubscribeTransactions

Articles from Transactions

Halcon’s Utica Test Wells Disappoint Analysts; EVEP Charges On

After disconcerting Utica Shale production figures were released earlier this month by Ohio regulators, industry analysts said they were disappointed with the results of the first two test wells Halcon Resources Corp. drilled in the play, and EV Energy Partners (EVEP) said it is continuing to look for buyers interested in its holdings there.

Kinder Launches Open Season for Oil Pipeline to California

Kinder Morgan Energy Partners LP (KMP) is holding a binding open season through May for capacity on the proposed 1,025-mile Freedom Pipeline LLC for transporting Permian Basin crude from Texas to refineries in both Southern and Northern California.

Wellinghoff: FERC Won’t Appeal Hunter Ruling to High Court

FERC does not intend to appeal a recent court finding that the agency lacks jurisdiction over natural gas futures transactions, said Commission Chairman Jon Wellinghoff.

Chesapeake Shares Soar on Report to Sell Midstream Businesses

Chesapeake Energy Corp. is in advanced negotiations to sell all of its midstream assets, including its stake in Chesapeake Midstream Partners LP (CHKM), for more than $4 billion, a transaction that could be completed in the next few days, sources told NGI’s Shale Daily on Wednesday. The bidder is said to be private equity giant Global Infrastructure Partners (GIP), which initially helped to fund the master limited partnership (MLP) and which continues to be a joint partner.

Nexen Takes Pacific Rim Partners in GOM, Shale Projects

Nexen Inc. last week secured two joint ventures (JV) in two separate transactions, both with Asian companies, that promise to give the Calgary-based independent a solid footing to expand development in the Gulf of Mexico (GOM) as well as British Columbia (BC).

Tax Panel: Dem Tax Proposal Could Shave Deficit by $352B

The Joint House-Senate supercommittee Tuesday was called on by a coalition of Senate and House Democrats to include a 0.03% tax on banking and financial firms’ nonconsumer transactions, including trading of derivative contracts, options, puts, forward contracts, swaps and other complex instruments, in their upcoming deficit-reduction legislation.

Chesapeake Enters $3.4B JV in Utica Play

Two transactions to monetize a portion of Chesapeake Energy Corp.’s 1.5 million net acres in the Utica Shale of Ohio are expected to give the independent about $3.4 billion in proceeds, CEO Aubrey McClendon said late Thursday.

Chesapeake Takes Partner in Utica Play

Two transactions to monetize a portion of Chesapeake Energy Corp.’s 1.5 million net acres in the Utica Shale of Ohio are expected to give the independent about $3.4 billion in proceeds, CEO Aubrey McClendon said late Thursday.

ExxonMobil Teams Up to Explore Argentine Shale

Wrapping up a busy Tuesday of transactions with an overarching theme of cooperation on different continents, an ExxonMobil Corp. subsidiary has entered a farm-out agreement with a subsidiary of Canada-based Americas Petrogas for the exploration and potential exploitation of shale in Americas Petrogas’s Los Toldos blocks (163,500 gross acres) located in Neuquen, Argentina.