Ukraine’s natural gas storage inventories are growing with European traders sending more supply to the country as stocks elsewhere on the continent are brimming. Ukraine Energy Minister German Galushchenko said Wednesday on the social media platform Telegram that foreign traders had pumped 1.8 billion cubic meters (Bcm), or about 64 Bcf, into the country’s underground…

Traders

Articles from Traders

Daily Transactions Taking Bigger Share of Pie in Latest Mexico Gas Price Survey

The Mexico gas market is increasingly trading in the daily market, according to the third survey of natural gas buyers and sellers in Mexico conducted by NGI’s Mexico GPI. According to respondents, 52% of all gas bought and sold in Mexico is done in the daily market, well above 12% in April 2019 and 28%…

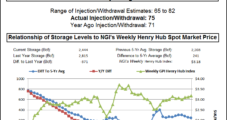

Expected Plump Storage Build Has Bears Energized; October Called A Penny Lower

October natural gas is expected to open a penny lower Thursday morning at $3.05 as traders anticipate the release of government storage data showing injections well above historical averages. Overnight oil markets were mixed.

NatGas Futures, Cash Inch Lower; Storage Receives Bearish Injection News

Physical natural gas for delivery Friday slipped lower in Thursday’s trading, with robust losses in the Northeast as well as softness in Appalachia and the Midwest offsetting modest strength in the Midcontinent, California, and the Rockies. The NGINational Spot Gas Average fell 1 cent to $2.92.

NatGas Cash Zigs, Futures Zag, But May Drops 6 Cents

Physical natural gas prices and futures prices parted ways in Monday trading as gas for next-day delivery surged and futures slumped.

NatGas Cash Surges, Buoyed by Eastern Gains; Futures Add A Penny

Weekend and Monday natural gas rocketed higher in trading Friday, led by Herculean advances at eastern market points.

NatGas Cash Languishes While Futures Score New High; Expired January Adds 17 Cents

Physical gas for delivery Thursday moved little in Wednesday’s trading as gains in Texas, the Southeast and Appalachia narrowly offset weakness in the Northeast, Rockies and California. The NGI National Spot Gas Average rose 1 cent to $3.61.

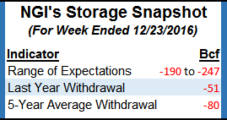

NatGas Traders Skeptical As Futures Surge Post-EIA Data

Natural gas futures worked higher Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was slightly less than what traders were expecting.

NatGas Cash Follows Screen Higher; November Makes It Six In A Row

Both natural gas physical and futures values vaulted higher in Monday’s trading in spite of a lack of supporting fundamental factors. Most of the day’s gains can be attributed to a strong screen and a sympathetic move with the petroleum sector, which has exceeded traders expectations.

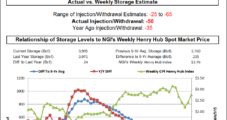

Thin Storage Build Anticipated; August Called Unchanged

August natural gas is set to open unchanged Thursday morning at $2.86 even though traders anticipate the release of well below-average storage data and a supportive weather environment. Overnight oil markets fell.