Houston-based Silver Run Acquisition Corp. II, an energy-focused special purpose entity sponsored by an affiliate of Riverstone Holdings LLC, has closed its initial public offering (IPO) for $1.035 billion gross. The record-breaking blank check offering, headed by former Anadarko Petroleum Corp. CEO Jim Hackett, plans to enter into a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination “with one or more businesses.” The IPO was priced at $10/share and sold 103.5 million units, including 13.5 million in the over-allotment option. The initial Silver Run blank check offering, now Centennial Resource Development Inc., is targeting the Permian Basin.

Tract

Articles from Tract

Halcon Entering Permian’s Southern Delaware, Selling Eagle Ford

Halcon Resources Corp. is entering the bustling Delaware Basin through a deal to acquire 20,748 net acres in Pecos and Reeves counties, TX, in the southern portion of the play, which is a sub-basin of the Permian. Simultaneously, the company is selling up in the Eagle Ford.

Chesapeake Markets 94,000-Acre Utica Package

Chesapeake Energy Corp. has carved out a 94,000-acre tract in Ohio’s Stark and Portage counties to sell, land that represents roughly one-tenth of its leasehold in the Utica/Point Pleasant Shale.

Marcellus Partner EOG Won’t Hit Drilling Target, Says Seneca

Seneca Resources Corp. has reduced its outlook in the Marcellus Shale after long-time joint venture (JV) partner EOG Resources Inc. said it didn’t expect to drill the minimum number of wells that were defined under an area of mutual interest (AMI).

ConocoPhillips Is High Bidder in First Post-Macondo Auction

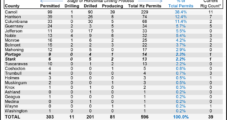

ConocoPhillips last Wednesday bid $103.2 million for a tract in the western Gulf of Mexico (GOM), making it the highest bidder in the first auction held by the federal government in the region since the Macondo well blowout in 2010 (see see NGI, April 26, 2010).

ConocoPhillips Is High Bidder in First Post-Macondo Auction

ConocoPhillips Wednesday bid $103.2 million for a tract in the western Gulf of Mexico (GOM), making it the highest bidder in the first auction held by the federal government in the region since the Macondo well blowout in 2010 (see Daily GPI, April 26, 2010).