Steel manufacturer Nucor Corp. said it will spend more than $700 million during a two-year period on natural gas drilling in order to meet its contractual obligations with Encana Corp. for a supply of low-cost natural gas.

Timing

Articles from Timing

BreitBurn Gains Oklahoma Panhandle Assets in Whiting Deal

BreitBurn Energy Partners LP is adding to its Permian Basin portfolio after agreeing to pay about $860 million for stakes in Whiting Petroleum Corp.’s Postle and North East Hardesty oilfields in Oklahoma.

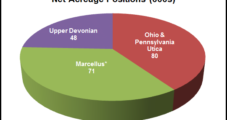

Rex Energy ‘Pleased’ With Results So Far in Utica Shale

Rex Energy Corp. said it is “pleased” with the results so far from a well targeting Ohio’s Utica Shale, but it is disappointed with a third-party well completion technique at a second well and blamed bad weather for delays in putting other wells into sales.

Low NatGas Prices Created Early Spring Storage Deficit, Analyst Says

A U.S. natural gas storage surplus of 463 Bcf on Feb. 15 had tumbled to a 32 Bcf deficit by May 24, a 495 Bcf decline that “ranks among the strongest we have seen, and oddly, the timing was in the late winter and early spring,” analysts at Stephen Smith Energy Associates said in their most recent Monthly Energy Outlook.

Customers Adding Fewer Rigs Than Expected, Says Schlumberger CEO

North American oilfield services activity in the first three months of this year has been less promising than expected, according to Schlumberger Ltd. CEO Paal Kibsgaard.

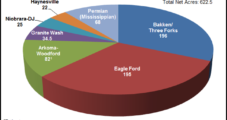

SM Energy Targeting Eagle Ford, Bakken/Three Forks, Permian

SM Energy said Wednesday that next year it will spend 90% of its planned drilling and completions budget of $1.2 billion on its Eagle Ford, Bakken/Three Forks and Permian Basin programs.

Halliburton Makes Costly Bet on Guar Gum

A bet to procure a big reserve of guar gum, an additive used in hydraulic fracturing (fracking) fluid, proved to be a costly mistake in the second quarter, Halliburton Co. CEO Dave Lesar told energy analysts on Monday.

Credit Crunch Ahead for Gas Drillers?

Because of the timing of the decrease in natural gas prices, and a “timely hedge book,” exploration and production (E&P) companies mostly have “coasted” through 1Q2012’s borrowing base season, but there may come a point when commercial banks may not continue to use a lending gas price deck well above strip prices, the energy team at Raymond James & Associates Inc. said last week.

Credit for Gas-Heavy Drillers Expected to Contract

Because of the timing of the decrease in natural gas prices, and a “timely hedge book,” exploration and production (E&P) companies mostly have “coasted” through 1Q2012’s borrowing base season, according to energy analysts with Raymond James & Associates Inc. However, commercial banks may not continue to use a lending gas price deck well above strip prices, wrote Kevin Smith, John Freeman and Justin Albert in a note to clients.

California Rekindles Fracking Proposal; Producers Back One Bill

California lawmakers are rekindling an effort that died last year to place chemical disclosure requirements on oil and natural gas producers that use hydraulic fracturing (fracking) well stimulation.