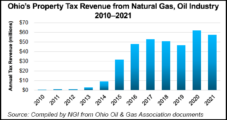

Natural gas and oil operations in eight Ohio counties alone provided $364 million in property taxes between 2010 and 2021, with taxes in 2020 and 2021 reaching record highs. Ohio’s top ranking counties for property tax generation in 2021, the most recent year for data, were Belmont ($17.26 million), Jefferson ($11.19 million) and Monroe ($10.63…

Taxes

Articles from Taxes

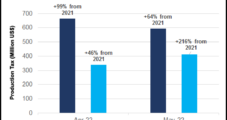

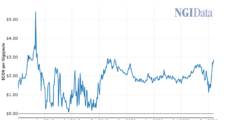

September Natural Gas, Oil Production Taxes Add $1B to Texas Treasury

Natural gas and oil production taxes generated more than $1 billion for the Lone Star State in September, the Texas Comptroller of Public Accounts reported. The Texas Comptroller’s office said the natural gas production tax garnered $480 million last month, representing a 91% year/year increase. The state collected $552 million from its oil production tax…

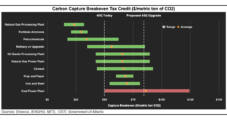

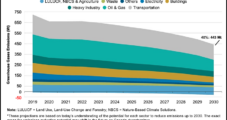

Inflation Reduction Act Seen Vastly Improving CCUS Economics for Natural Gas Power Plants

The Inflation Reduction Act of 2022 (IRA) could more than double the amount of carbon dioxide (CO2) emissions that can economically be abated via carbon capture, storage and utilization (CCUS), according to modeling by Enverus. Natural gas-fired power plants, oil refineries and upgraders, as well as cement production, are among the emitting sources that would…

Oil, Natural Gas Industry Reaction Mixed as Blockbuster Climate, Spending Bill Heads to Biden’s Desk

The House on Friday passed the Senate-approved Inflation Reduction Act of 2022 (IRA) by a margin of 220-207, clearing the way for President Biden to sign the landmark climate and energy bill into law. The legislation includes investing an estimated $370 billion to decarbonize domestic energy and transport sectors, and it targets a roughly 40%…

State Data Show Everything is Bigger in Texas, Including Natural Gas Taxes

Texas’ natural gas production tax garnered $413 million for the state in May, representing a 216% year/year increase and an all-time high for the levy, the Texas Comptroller of Public Accounts said Wednesday. The state took in $595 million from its oil production tax in May, up 64% year/year, the Texas Comptroller’s office added. Much…

For Canada’s Natural Gas and Oil Producers, Federal Budget’s CCUS Tax Incentives Fall Short

The Canadian government made a commitment Thursday to help cover expenses of reducing industrial greenhouse gas (GHG) emissions by providing investment tax credits for carbon capture, utilization and storage (CCUS). The 2022 federal budget plan presented by Finance Minister Chrystia Freeland set CCUS tax credit rates of 60% for direct air capture systems, 50% for…

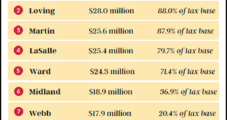

Permian, Eagle Ford Counties and School Districts Top Texas Property Tax Receipt Rankings

Texas’ oil and natural gas industry paid $15.8 billion in state and local taxes and state royalties in Fiscal Year (FY) 2021, with school districts and counties in the Permian Basin and Eagle Ford Shale the top beneficiaries, according to the Texas Oil and Gas Association (TXOGA). “Despite an incredibly difficult two years, the Texas…

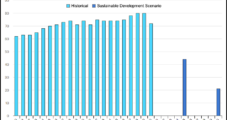

Alberta E&P Taxes to Decline on Government Response to Covid-19

Alberta natural gas and oil producers predict their annual taxes will drop by C$85 million ($64 million) thanks to provincial and municipal reductions announced Monday as a response to the Covid-19 andemic. The relief program for exploration and production (E&P) companies cuts levies on wells, drilling equipment, pipelines and industrial property for three years. While…

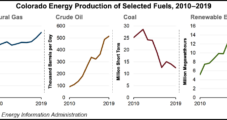

Colorado Oil, Natural Gas Regulator Raises Mill Levy to Balance Budget Amid Pandemic

The Colorado Oil and Gas Conservation Commission (COGCC) has adopted a mill levy rate increase in order to balance its budget amid revenue shortfalls caused by the Covid-19 pandemic and subsequent downturn in commodity pricing. Mill levies, the regulator’s main source of revenue, are property taxes whose rates are expressed in mills, which are equal…

Texas Natural Gas, Oil Industry in FY2019 Generated $16B-Plus in Taxes and Royalties

The natural gas and oil industry in Texas paid more than $16 billion last year in combined state/local taxes and in royalties, the highest in history, according to the Texas Oil & Gas Association (TXOGA).