Ohio pure-play Eclipse Resources Corp. plans to significantly increase its capital spend this year, guiding for a $300 million budget that builds on the lessons it learned last year and includes 11 super laterals — wells with extensions of 15,000 feet or longer.

Super

Articles from Super

Eclipse Sets Sights on Two-Rig Program, More ‘Super Laterals’ As Outlook Improves

After reviving its idled drilling program, increasing this year’s capital expenditures and starting work again on its drilled but uncompleted (DUC) wells during the second quarter, Ohio pure-play Eclipse Resources Corp. said Wednesday its recovery could gain significant speed by mid-year 2017.

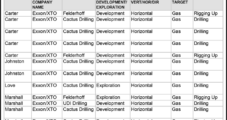

Supermajors Bankrolling Most North American E&P Spending

ExxonMobil Corp., Chevron Corp., BP plc and super independent ConocoPhillips are expected to lead all other exploration and production (E&P) spenders in the United States this year, with capital expenditures (capex) on average about 5% higher than in 2012, according to a survey by Barclays Capital. Last year’s No. 2 spender, Chesapeake Energy Corp., dropped to No. 5 after cutting its exploration plans.

ExxonMobil Builds Woodford War Chest

ExxonMobil Corp.’s quest to remain the biggest operator in the Ardmore Basin’s Woodford Shale remains on track after the super major agreed to pay $147.5 million to buy the bulk of BNK Petroleum Inc.’s leasehold in the Tishomingo Field.

ExxonMobil Builds Woodford War Chest

ExxonMobil Corp.’s quest to remain the biggest operator in the Ardmore Basin’s Woodford Shale remains on track after the super major agreed to pay $147.5 million to buy the bulk of BNK Petroleum Inc.’s leasehold in the Tishomingo Field.

ExxonMobil Proved Reserves Top 25.2 Billion Boe

ExxonMobil Corp. in 2012 replaced 115% of its production, which included 56% of natural gas output, by adding proved reserves totaling 1.8 billion boe, the super major said last week.

ExxonMobil Proved Reserves Hit 25.2 Billion Boe

ExxonMobil Corp. replaced 115% of its 2012 production by adding proved reserves totaling 1.8 billion boe, the super major said Tuesday.

Tight LNG Supplies Lead Northeast Advance; Futures Seen Lower

The overall physical natural gas market Tuesday on average gained 12 cents, but if super-sized gains scored at Northeast points are removed from the tally, the overall gain was a more modest 7 cents. Gains, nonetheless, were widespread and only a couple of locations didn’t make it to the positive side of the trading ledger. At the close of futures trading, March had fallen 4.9 cents to $3.230 and April was off 5.0 cents to $3.296. March crude oil added 48 cents to $97.51/bbl.

February Contract Settles Softly; Cash Continues Lower

Physical gas markets were led lower again by the super-sized declines posted at eastern and northeast locations. Overall, the market averaged a 33-cent decline, but if the multi-dollar losses on New England and eastern pipes are factored out, the average loss was just a nickel.

Regulators Rewrite the Rules After Alberta Fracking Mishap

An 11-month investigation into an Alberta drilling mishap has confirmed that hydraulic fracturing (fracking) poses a unique fluid spill risk and prompted regulatory steps to control the danger.