Goodrich Petroleum Corp. is buying a 66.7% working interest in producing assets and about 277,000 gross acres in the Tuscaloosa Marine Shale (TMS) for $26.7 million as it continues to build scale in the play and improve its drilling performance.

Suggest

Articles from Suggest

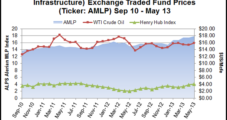

Raymond James: Shale-Driven Infrastructure Boom Has Staying Power

The continued uptrend in North America’s unconventional natural gas and oil supplies and global demand dynamics suggest that the outlook for pipeline and storage infrastructure development may not only be bullish but also long-term, according to analysts with Raymond James & Associates Inc.

Fracking Study Was Not ‘Peer-Reviewed,’ Editor Says

A study of data from the Pennsylvania Department of Environmental Protection (DEP) that showed the percentage of wells with pollution events has declined, thanks at least in part to the state’s regulation of hydraulic fracturing (fracking), was not “peer-reviewed,” as it was originally described, according to an editor’s note issued since the study’s release.

Prices Flat or Higher Across the Board

Generally moderate weather predictions, such as the Chicago area reaching the low to mid 50s Tuesday, didn’t suggest any likelihood of spot prices increasing Monday. But cash traders either thought otherwise or were looking ahead to near the end of the week, when cold fronts would be moving into such areas as the Midwest.

Pennsylvania Impact Fee Moves, But Slowly

A Pennsylvania Senate committee moved Marcellus Shale impact fee legislation forward on Wednesday, but observers suggest that the move is mainly procedural and say there is still much work to be done.

‘No Direct Link’ Between Fracking and Contaminated Groundwater

Preliminary findings from a study being conducted by The University of Texas at Austin’s (UT) Energy Institute suggest no direct link between hydraulic fracturing (fracking) and groundwater contamination, researchers said Wednesday.

Factors Seen in Place for Market Advance; November Gains

November natural gas advanced Tuesday as traders suggest that the market is close to breaking out of its current directionless malaise and move higher. At the close November had gained 5.4 cents to $3.658 and December was up by 5.8 cents to $3.852. December crude oil gained $1.90 to $93.17/bbl.

Seasonal Demand Thought to Lift Prices, But October Falls

October futures eased Monday as traders see largely weather-driven weakness in the near term but suggest stronger prices once the heating season kicks in. At the close October had fallen 3.0 cents to $3.885 and November had given up 3.2 cents to $3.966. October crude oil rose 95 cents to $88.19/bbl.

End-Users See Little Change in Market Risk; August Eases

August natural gas retreated moderately Tuesday, but risk managers don’t see any change in the overall market landscape and suggest that a severe storm may be required to change client’s risk assessments. At the close August had eased 1.3 cents to $4.533 and September had fallen 1.3 cents as well to $4.511. August crude oil rose $1.57 to $97.50/bbl.

QOGA President Welcomes Quebec Shale Report

Former Quebec Premier Lucien Bouchard, who now serves as president of the Quebec Oil and Gas Association (QOGA), said the organization welcomed the provincial government’s response to a report on hydraulic fracturing (hydrofracking) in the Utica Shale play.