Stone Energy Corp. intends next year to continue shifting capital away from its Appalachian Basin assets under a plan that would cut its budget by more than half from 2015 levels and find it spending more heavily in the deepwater Gulf of Mexico as it did this year.

Stone

Articles from Stone

Stone Energy Curtails Nearly All Appalachian Production on Low Prices

Stone Energy Corp. has shut-in its largest field in the Appalachian Basin, curtailing between 100 and 110 MMcfe/d of Marcellus Shale production to offset low commodity prices and negative differentials that had reached “unacceptable levels,” the company said.

Devon’s Permian, Mississippian Topping Expectations

Devon Energy Corp. is increasing its oil-directed drilling this year across the Permian Basin and in the emerging Mississippian Lime as it continues its transition from a natural gas heavyweight, CEO John Richels said Tuesday.

Industry Briefs

The Environmental Defense Fund (EDF) wants to hire a “state regulatory and legislative affairs manager” based in Washington, DC, who would to focus on natural gas. The manager would ” assist in organizing and managing efforts to enact a comprehensive set of regulations and reforms in key natural gas producing states,” with emphasis on the…

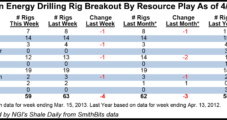

Shale Basins Demonstrate Maxim: Reduced Drilling Begets Higher Prices

Natural gas prices in the various North American shale basins rose about 50 cents, or close to 20%, year-to-year from Jan. 1, 2012 to Jan. 1, 2013, moving mainly from the $2.80s to the $3.30s per MMBtu. At the same time, operating rigs in the same basins dropped 21%, according to surveys conducted throughout the year for NGI’s Shale Daily.

Noble Energy, Stone Energy Agree to More Risk Disclosures

Noble Energy Inc. and Stone Energy Corp. have agreed to make additional disclosures of how they are managing the risks associated with hydraulic fracturing (fracking), an investment manager organization said Thursday.

Canadians Thaw Out Plan for Arctic LNG

No stone is being left unturned, including the fabled Northwest Passage, in the quest to resurrect an expansion of Canadian natural gas supplies for anticipated market growth in the United States. The latest dormant plan to be taken out of industry freezers for a fresh run through serious economic study is a grand design born in the “energy crisis” era of the 1970s for icebreaking tankers to deliver liquefied gas south from Canada’s Arctic Islands.

Canadians Thaw Out Plan for Arctic LNG

No stone is being left unturned, including the fabled Northwest Passage, in the quest to resurrect an expansion of Canadian natural gas supplies for anticipated market growth in the United States. The latest dormant plan to be taken out of industry freezers for a fresh run through serious economic study is a grand design born in the “energy crisis” era of the 1970s for icebreaking tankers to deliver liquefied gas south from Canada’s Arctic Islands.

MMS: Competition Pushes Central Gulf Lease Sale Bidding to 6-Year High

Amerada Hess, BHP Billiton, Stone Energy, Pogo Producing and Tana Exploration were the top five companies based on total amount of high bids in the Minerals Management Service’s Central Gulf Lease Sale 190. The agency said 83 companies submitted $368.8 million in high bids, which was a 17% increase compared to Central Gulf Lease Sale 185 just last year. The total of all bids was $636.8 million.

MMS: Competition Pushes Central Gulf Lease Sale Bidding to 6-Year High

Amerada Hess, BHP Billiton, Stone Energy, Pogo Producing and Tana Exploration were the top five companies based on total amount of high bids in the Minerals Management Service’s Central Gulf Lease Sale 190. The agency said 83 companies submitted $368.8 million in high bids, which was a 17% increase compared to Central Gulf Lease Sale 185 just last year. The total of all bids was $636.8 million.