BreitBurn Energy Partners LP is adding to its Permian Basin portfolio after agreeing to pay about $860 million for stakes in Whiting Petroleum Corp.’s Postle and North East Hardesty oilfields in Oklahoma.

Stakes

Articles from Stakes

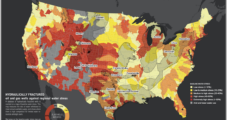

Find Fracking Solutions in ‘Water-Stressed’ U.S. Regions, Says Ceres

Energy industry efforts to reduce the amount of water used in hydraulic fracturing (fracking) through recycling and other means have to be stepped up if unconventional resources are to grow as projected, according to Ceres, which runs an influential institutional investor coalition.

Western Gas Buys Stakes in Marcellus NGL Systems

Western Gas Partners LP is expanding its business in the Marcellus Shale after agreeing to pay $620 million-plus for stakes in two natural gas liquids (NGL) gathering systems in Pennsylvania that have combined throughput of more than 1.2 Bcf/d.

Lighthouse Increases TMS Stake, Will Put Two Wells Into Production

Lighthouse Petroleum Inc. said Thursday it will explore for oil in the Tuscaloosa Marine Shale (TMS), disclosing that it had acquired stakes in two wells in St. Helena Parish, LA.

TransCanada Buys BP’s Stakes in Storage Partnership

TransCanada Corp. agreed to pay BP plc C$210 million to buy out the producer’s interest in the Crossfield Gas Storage facility near Edson, AB, as well as its stakes in an affiliated marketing joint venture (JV) between the two operators.

BP Puts GOM Fields Up for Sale

BP plc, still coming to terms with the devastating Macondo well blowout two years ago, said Tuesday it is selling one Gulf of Mexico (GOM) field and stakes in four others.

Encana Takes Partners in Wyoming’s Jonah Field

Houston-based Contango Oil & Gas Co., better known as a Gulf Coast player, on Monday joined with some financially savvy partners to invest up to $380 million over the next five years in Encana Corp.’s holdings in the Jonah field, one of the largest natural gas fields in the United States and the third largest oilfield in Wyoming.

Foreigners, Private Equity Said Eyeing Big U.S. Unconventional Deals

Foreign buyers up to now have been gaining intelligence about drilling in North America’s prolific unconventional formations through joint ventures (JV) and region-specific acquisitions with willing U.S. natural gas and producers, but that’s about to change, according to an energy expert with industry consultant PwC US.

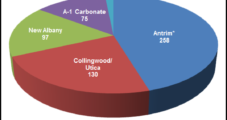

Chesapeake Completes Sale of Utica JV Shares

Chesapeake Energy Corp. has completed the sale of $750 million of perpetual preferred shares of its newly formed entity CHK Utica LLC, the Oklahoma City-based producer said Monday.

Chesapeake Eyes JVs for at Least Three More Shale Plays

Chesapeake Energy Corp. plans to sell stakes in at least three more onshore U.S. shale plays, CEO Aubrey McClendon told energy analysts Friday, and at the same time he claimed a leadership position for the company in the new natural gas age.