ExxonMobil Corp. has sharply reduced its capital spending plans this year but management is eyeing potential acquisitions while commodity prices are weak, CEO Rex Tillerson said Wednesday. The only issue is that sellers still have unrealistic price expectations, he said during the annual analyst conference in New York City.

Spending

Articles from Spending

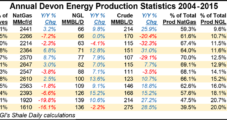

Devon’s Mantra for 2016: Protect the Balance Sheet

Pragmatic about what it can — and cannot — accomplish in the current environment, Devon Energy Corp. has no plans to accelerate exploration and production “in a $30.00 and $2.00 world,” CEO Dave Hager said Wednesday. Top line production is forecast to decline by 6% in 2016, led by a sharp pullback in onshore natural gas fields.

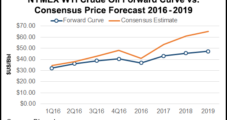

As U.S. E&Ps Ax Budgets, Raymond James Forecasting Sharper Decline in Rig Count

Raymond James & Associates Inc. analysts are standing by their call for West Texas Intermediate oil prices to reach $50/bbl later this year in the face of a futures strip that is “simply unsustainable,” but until the price cavalry arrives, the U.S. rig count is going to be hacked even more as producers cut back their spending.

E&P Capex Outlook Grimmer, With U.S. Spending Possibly Falling 40-50%

Oversupplied oil and natural gas markets, now coupled with sharply declining oil prices, are setting up a dismal year for capital spending by exploration companies, with domestic operators possibly cutting their spend plans by as much as half from 2015, analysts said this week.

NGI The Weekly Gas Market Report

Freeport-McMoRan Suspending Dividend, Dropping Rigs in Deepwater GOM

Freeport-McMoRan Inc. (FCX), which for months has been eyeing strategic options for its U.S.-focused oil and gas business, said Wednesday it has suspended its dividend and is dropping deepwater rigs in the Gulf of Mexico (GOM) to cope with deteriorating market conditions.

E&Ps Expected to Spend Close to Cash Flow in 2016, ‘Growth Be Damned’

Third quarter results for exploration companies are about to begin, with the oilfield services sector kicking things off this week and next, and interest is especially keen on what the spending plans are for 2016. Consensus by three analyst groups is a double-digit decline from 2015 levels, with spending well below the halcyon days before the oil crash.

In Midyear Review, U.S. E&P Spending Still Seen Down 30% From 2014

U.S. oil and gas exploration and production companies have slashed capital spending to control costs, as well as conserve cash flow and liquidity…

In Midyear Review, U.S. E&P Spending Still Seen Down 30% From 2014

U.S. oil and gas exploration and production (E&P) companies have slashed capital spending to control costs, as well as conserve cash flow and liquidity, but it’s unlikely lower spending will translate into lower production this year, a review by Standard & Poor’s Ratings Services (S&P) has found.

U.S. Upstream Capex Curtailments Twice Global Average, Says Raymond James

Global upstream spending began to peak last year before the oil price meltdown, but the sharp cuts in capital expenditures (capex) for 2015 have moved into a league of their own, i.e. “austerity on steroids,” according to Raymond James & Associates Inc.

Domino Effect of Lower Oil/Gas E&P Capex Now Hitting Offshore, Midstream

Capital spending reductions by exploration firms and the pace of falling rigs have moved beyond trivial and now pose real dangers to 2015 prospects, according to analysts.