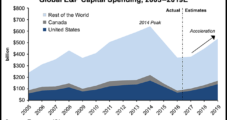

North America will spearhead a recovery in global upstream investment in 2017, with U.S. spending — weighted on the onshore — forecast to jump by 24.5%, while Canada outlays will be 9.5% higher, according to an annual survey by Evercore ISI.

Spending

Articles from Spending

Chevron Priming Permian Pump in 2017

The Permian Basin will be Chevron Corp.’s No. 1 U.S. target in 2017, as the supermajor moves more of its worldwide capital spending to high-return, short-cycle projects.

Sanchez Raises Spending After Beating 2Q Guidance

Houston-based Sanchez Energy Corp. second quarter production exceeded the high end of guidance, and now the company plans to raise spending by up to $50 million with an eye on growing production by 5-8% next year, it said Monday.

Briefs — Bear Head LNG, Philadelphia Gas Works

The planned Bear Head LNG project on the Strait of Canso in Nova Scotia has received final National Energy Board (NEB) approval to import U.S. natural gas and export liquefied natural gas (LNG) from the terminal. The NEB approval was previously issued in August 2015 (see Daily GPI,Aug. 17, 2015) but was subject to the approval of the Governor in Council, which was received Thursday, said Bear Head LNG Corp., a unit of Australia’s Liquefied Natural Gas Ltd. Bear Head LNG has approval from the U.S. Department of Energy to export U.S.-sourced natural gas to nations with and without free trade agreements with the United States.

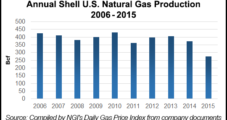

Shell Facing ‘Hard Choices’ for Proposed Pennsylvania Cracker, North American LNG

Royal Dutch Shell plc has reduced its 2016 capital spending by another 10% and warned Wednesday that low natural gas and oil prices are continuing to weigh on executing expansion plans in North America.

Shell Facing ‘Hard Choices’ for Proposed Pennsylvania Cracker, North American LNG

Royal Dutch Shell plc has reduced its 2016 capital spending by another 10% and warned Wednesday that low natural gas and oil prices are continuing to weigh on executing expansion plans in North America.

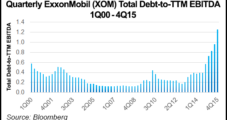

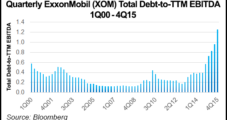

S&P Clips ExxonMobil’s ‘AAA’ Rating

After carrying a “AAA” credit rating for more than 66 years, ExxonMobil Corp. was brought down a notch by Standard & Poor’s Ratings Services (S&P) on Tuesday, citing expectations for continuing low oil and natural gas prices, high reinvestment requirements and large dividend payments.

S&P Clips ExxonMobil’s ‘AAA’ Rating

After carrying a “AAA” credit rating for more than 66 years, ExxonMobil Corp. was brought down a notch by Standard & Poor’s Ratings Services (S&P) on Tuesday, citing expectations for continuing low oil and natural gas prices, high reinvestment requirements and large dividend payments.

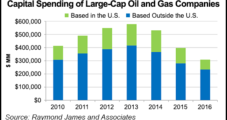

Global NatGas, Oil Capex Reductions at ‘Unprecedented’ Level, Says Raymond James

The global oil and natural gas industry has responded to the commodity meltdown with severe curtailments in capital spend, but the level of austerity implemented worldwide is unprecedented and undoubtedly will lead to a supply response, according to a survey of top-tier operators by Raymond James & Associates Inc.

Raymond James Says E&Ps Focused on Lower 48 Cutting Capex Most

The biggest capital spending reductions in the global oil and natural gas industry are — no surprise — led by producers whose assets are concentrated in the Lower 48 states, Raymond James & Associates Inc. said Monday.