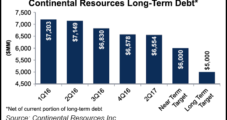

Continental Resources Inc. CEO Harold Hamm said he would use asset sales and reduce activity in the Midcontinent, including the Springer Shale, to pare down long-term debt, which stood at $6.56 billion at the end of June.

Sold

Articles from Sold

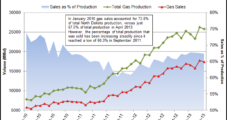

Flaring Remains a Stubborn Problem in North Dakota

Connecting the wells only addresses part of the problem with flaring of natural gas in North Dakota’s Bakken and Three Forks formations; it’s no help if there’s a lack of takeaway and processing capacity.

Texas Lawmakers Pass Oil/Gas Waste Bill

The Texas Senate has passed HB 2767, which is intended to encourage the recycling of wastewater from drilling and hydraulic fracturing operations for reuse rather than injection of the waste into disposal wells. The legislation aims to clear up legal ambiguities around responsibility for transferred drilling waste.

Ohio Water District Sells More Water to Gulfport, Enacts New Policy

The Muskingum Watershed Conservancy District (MWCD) has agreed to sell more water to Gulfport Energy Corp. for Utica Shale drilling activities, as it adopts a new short-term water sales policy and partners with the U.S. Geological Survey to study the impact of future water withdrawals.

Wattenberg Oil, Marcellus Gas Lift Anadarko Onshore Output

Strong liquids and oil growth from the Greater Wattenberg Field in Colorado, and stronger-than-expected natural gas output from the Marcellus Shale, contributed to record volumes in the first quarter by Anadarko Petroleum Corp.

BLM Sells Leases in Unconventional Nevada Play

A total of 29 parcels comprising 35,889 acres in a promising unconventional find in northeastern Nevada were sold to six companies for a total of $1.27 million by the Bureau of Land Management (BLM) during its quarterly oil and gas competitive lease sale held in Reno, NV, the agency said.

Trans Energy Sells Shallow Assets, Connects Two Wells to Pipeline

Trans Energy Inc. announced Wednesday that it had sold its drilling rights and working interest in shallow wells targeting the Devonian Shale for $2.75 million before adjustments, but had retained a royalty interest on most wells and drilling rights to deeper formations, such as the Rhinestreet, Marcellus and Utica shales.

Industry Brief

Enterprise Products Partners LP has sold out capacity at its planned 1.65 billion pounds/year propane dehydrogenation (PDH), which is scheduled to begin operation during the third quarter of 2015. In anticipation of a continuing decrease in supplies of propylene, Enterprise is in talks with additional customers that could lead to the development of additional PDH capacity, the company said. Last June Enterprise said it would build a PDH facility on the Texas Gulf Coast that would consume up to 35,000 b/d of propane to produce 1.65 billion pounds/year (750,000 metric tons per year or 25,000 b/d) of polymer-grade propylene (PGP) (see Shale Daily, June 22, 2012). The facility is to be integrated with the partnership’s existing propylene fractionation facilities, which have capacity of 5.3 billion pounds/year. The PDH facility will also be integrated with Enterprise’s PGP storage facilities, 102-mile distribution pipeline system and export terminal. “This [PDH capacity] demand is being driven by the combination of a 38% decrease in propylene supplies since 2006 due to additional ethane consumption by U.S. petrochemical companies and the growing supplies of domestic propane from the U.S. shale plays,” said Jim Teague, COO of Enterprise’s general partner.

Pennsylvania Governor: Shale Development ‘Good For Entire State’

Pennsylvania Gov. Tom Corbett said development of the Marcellus Shale was “good for the entire state” but conceded that several challenges lay ahead, in part because natural gas prices remain less than $3/Mcf.

Encana Takes Partners in Wyoming’s Jonah Field

Houston-based Contango Oil & Gas Co., better known as a Gulf Coast player, on Monday joined with some financially savvy partners to invest up to $380 million over the next five years in Encana Corp.’s holdings in the Jonah field, one of the largest natural gas fields in the United States and the third largest oilfield in Wyoming.