Dry natural gas production in the United States, boosted by stronger pipeline flows from the Marcellus Shale, led Goldman Sachs analysts on Monday to revise their forecasts down for prices and lift expectations for end-of-summer storage levels.

Shifts

Articles from Shifts

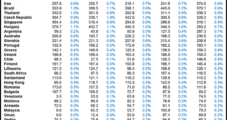

Baker Hughes: 2013 North American Rig Count to Decline 5%

Baker Hughes Inc.’s North American activity is predicted to be steady this year compared with 2012, but customers still remain cautious about what’s ahead, CEO Martin Craighead said Wednesday. Canadian projects also are posing “near-term risks,” he said.

PetroQuest Shifting to Liquids, Sells Fayetteville Assets for $9.2M

PetroQuest Energy Inc. said Monday it has closed on the sale of its assets in the Fayetteville Shale for about $9.2 million as it shifts its focus to production of natural gas liquids (NGL) from other plays, including the Woodford Shale and the Mississippian Lime formation.

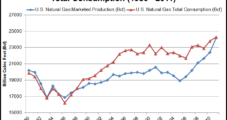

EIA: Shale ‘Central’ to Earlier Transition to NatGas Exports

Citing the onslaught of shale gas volumes, the Energy Information Administration (EIA) Wednesday projected that dry natural gas production will increase significantly throughout 2040, outpacing domestic consumption by 2020 and spurring net exports of natural gas sooner than the agency had expected.

Officials Tout Marcellus, Warn Global LNG Market Limited

The Marcellus Shale is a “solidly economic” shale play that could play a big role in the export of liquefied natural gas (LNG) from the United States to Europe and Asia, but regulatory hurdles, stiff competition and market forces are all significant obstacles, according to two energy industry experts.

Dominion Secures Liquids Agreement in Utica, Readies Expansions

Dominion Resources Inc. has secured a long-term natural gas gathering service agreement in northeastern Ohio with M3 Ohio Gathering (Momentum) to process wet gas from the Utica Shale and is readying several projects in the Utica and Marcellus shale region to expand capacity services, CEO Tom Farrell said Thursday.

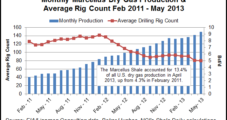

What Happens in the Marcellus Doesn’t Stay in the Marcellus

As production from the booming Marcellus Shale has grown and the emerging Utica Shale has made its presence felt, the Northeast, formerly a gas “have-not,” is pushing its own production outward to markets as pipelines race to catch up.

Industry Briefs

Utility rates changed at the start of the new year in California, Colorado and Oregon with the biggest shifts occurring at Xcel Energy’s Colorado combination utility. Xcel natural gas utility bills increased 1.55% for residential customers and 5.45% for small businesses, while electric rates dropped 6.48% for residential users and 7.08% for small businesses. In California, Pacific Gas and Electric Co. (PG&E) residential gas charges increased 1.8% as of Jan. 1, compared to December rates, but the new rates are still slightly lower (0.3%) than those in effect in January 2011. PG&E residential electric rates increased compared to December (2.4%) and January 2011 (2.9%). In Oregon, the two electric utilities’ rates went in opposite directions with PacifiCorp’s going up due to its reliance on more coal-fired generation and Portland General Electric’s (PGE) going down slightly due to its greater use of gas-fired and hydroelectric generation. PacifiCorp rates increased 4.4% or $51 million with the “largest single factor” being higher coal costs, said the Oregon Public Utility Commission, which cut $10.9 million from the multi-state utility’s original request. PGE rates dropped 1.3% or $21.8 million due mostly to the replacement of some nonhydro contracts with less expensive gas-fired generation contracts.

El Paso Putting Oil Ahead of Gas — in Eagle Ford Shale

Enthusiasm for uncovering oil deposits in the Eagle Ford Shale of South Texas hasn’t waned at El Paso Corp. In fact, the company likely will move more rigs into its leasehold as the year progresses, CEO Doug Foshee said Thursday.

Williams Grabs Bakken Acreage

As it shifts its portfolio toward more oily prospects, natural gas producer Williams Cos. last week agreed to pay $925 million to acquire 85,800 net acres in the Bakken Shale.