Comstock Resources Inc. plans to fund a boost in completions activity at its Haynesville Shale assets in Louisiana and Texas using the proceeds from selling properties in North Dakota. The Frisco, TX-based independent said Thursday it would exit the Bakken Shale, selling its assets to Northern Oil & Gas Inc. for $154 million in cash.…

Selling

Articles from Selling

Briefs– Baker Hughes NGS Sale

Baker Hughes, a GE company (BHGE), is selling its natural gas solutions (NGS) business, part of the turbomachinery and process solutions segment, in two separate agreements for a total of $375 million. The NGS product line is being sold to First Reserve in a transaction that includes three manufacturing sites in North America and the UK, as well as transferring 450 employees in eight countries. Separately, the Talamona, Italy branch of the NGS product line, which includes a manufacturing site, is being sold to Pietro Fiorentini SpA. Forty employees in Talamona also would be transferred. Both transactions are expected to close by the end of the year.

NGTL Expands Natural Gas Network Flows by About 1 Bcf/d

Western Canada producers are selling off a surplus of steeply discounted natural gas that piled up during a prolonged pipeline service interruption last year.

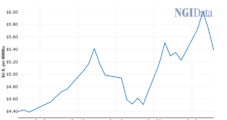

NatGas Slides on Long-Range Warm Forecast as February Called 12 Cents Lower

February natural gas was set to open Friday about 12 cents lower at around $2.759 as forecasters noted warmer changes to the medium- and long-range weather outlooks.

[Article Headline]

January natural gas was set to open about 4 cents higher at around $2.80 Friday, with the market showing signs of bouncing back from the prior day’s sell-off amid continued cold risks in the 11-15 day outlook.

Linn Emerging from Bankruptcy Sans Berry, With Onshore Assets For Sale

Linn Energy LLC, the natural gas-rich powerhouse partnership thatsuccumbed to bankruptcy last year, has emerged from Chapter 11 with a streamlined strategy that will cast off a big package of onshore U.S. assets and jettison the Berry Petroleum franchise it acquired in 2013.

Kinder Morgan Takes Partner in Ohio Ethane Pipeline Project

Kinder Morgan Inc. (KMI) is selling a 50% stake in its Utopia Pipeline Project, which when complete will be a conduit for ethane from Ohio to the Sarnia, ON, petrochemical market. The buyer is Riverstone Investment Group LLC.

FourPoint Buying Chesapeake’s Remaining Anadarko Basin Portfolio for $385M

One day after announcing it has sold stakes in onshore wells across the country, Chesapeake Energy Corp. on Wednesday secured an agreement to sell its remaining natural gas-heavy Anadarko Basin property for $385 million to a return buyer, privately held FourPoint Energy LLC.

Speculative Selling Fading; October Called 4 Cents Higher

October natural gas is set to open 4 cents higher Tuesday morning at $3.89 as traders continue to see a bearish trading environment, but there’s a hint that surprises could come to the upside. Overnight oil markets rose.

BLM Nets $49.8M from Dakotas Lease Auction

Continuing to fetch higher per-acre prices, the federal Bureau of Land Management (BLM) took in $49.8 million last Wednesday, selling 87 leases totaling 19,015 acres in North and South Dakota, the BLM Billings, MT, office said. South Dakota had the most activity.