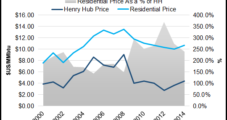

Low natural gas prices mean pain at the wellhead, but they continue to bring smiles at the residential burner tip, according to the latest J.D. Power customer satisfaction survey of gas utility customers.

Tag / Satisfaction

SubscribeSatisfaction

Articles from Satisfaction

Report of New York Frack Approval After Labor Day ‘Premature’

In a report that aired Sunday, CBS News said New York’s Department of Environmental Conservation (DEC) will make an announcement sometime after Sept. 3 that high-volume hydraulic fracturing (HVHF) will be allowed to move forward in the state, ending a four-year wait and an effective moratorium on the practice.

Nexen’s Focus on Select Regions Said Key to Gas Marketing Sales

Calgary-based Nexen Inc.’s natural gas marketing business is a consistent leader in the Mastiogale customer satisfaction surveys. And for several years, it’s been a regular on NGI’s Top 20 gas marketer surveys. The secret to its success? Focus.

Enterprise, GulfTerra Complete Merger

Enterprise Products Partners LP and GulfTerra Energy Partners LP are awaiting clearance by the Federal Trade Commission and satisfaction of other regulatory conditions to complete their merger, which was approved last week by unitholders for both companies. The merger, which will create the second largest publicly owned energy partnership in the United States, is expected to close in the third quarter.

Wood Expresses Satisfaction with CA Power Contract Settlements

FERC Chairman Pat Wood last Thursday said that he wasn’t disappointed with the number of settlements that were recently reached between several power suppliers and California over disputed high-priced contracts signed by the state during the 2000-2001 western energy crisis.

Industry Brief

Duke Energy announced Wednesday that the effective date for its acquisition of Westcoast Energy Inc. will be today, subject to the satisfaction of certain customary closing conditions. The transaction includes the acquisition of all outstanding common shares of Westcoast in exchange for a combination of cash, Duke common shares and exchangeable shares of a Canadian subsidiary of Duke that are substantially equivalent to and exchangeable on a one-for-one basis for Duke common shares. Under the terms of the agreement and based on an expected effective date of March 14, an exchange ratio of 0.7711 will be used to calculate the number of Duke common shares and exchangeable shares to be issued in exchange for Westcoast common shares. As a result of the anticipated closing of the acquisition, it was expected that Westcoast common shares would cease trading on the Toronto Stock Exchange and the New York Stock Exchange at the close of trading on Wednesday, and the exchangeable shares will begin regular trading on the Toronto Stock Exchange today under the symbol “DX.” First announced in late September 2001, the transaction is valued at $8.5 billion, including $4 billion in debt assumption (see Daily GPI, Sept. 21, 2001). The move is expected to greatly expand Duke’s North American natural gas pipeline holdings and position it for a strong role in future gas infrastructure expansions.