Robert Douglas Lawler, 46, one of Anadarko Petroleum Corp.’s top exploration and production (E&P) executives, last week was tapped to be CEO and president of Chesapeake Energy Corp.

Robert

Articles from Robert

West Virginia Officials to Discuss Industry’s Impact on Local Roads

State lawmakers in West Virginia plan to meet in Wheeling on Thursday to discuss the impact the oil and gas industry is having on local roadways.

People

Robert Douglas Lawler, tapped to be CEO of Chesapeake Energy Corp. beginning June 17, will earn more than co-founder and predecessor Aubrey McClendon, according to a Securities and Exchange Commission (SEC) filing (see Daily GPI, May 21). The compensation package for the first year of employment has the potential to total at least $22 million, if Lawler hits his bonus targets, the SEC Form 8-K indicated. Base salary is set at $1.25 million a year, with a cash bonus of at least $800,000 the first year, a cash signing bonus of $2 million, and shares and options worth $18 million. About $7.5 million of the shares and options are to be paid over the next five years. If Lawler stays for five years, he is to receive another $5 million. About $12.5 million of the share awards are to compensate for losses in pensions and benefits for leaving Anadarko Petroleum Corp. By comparison, McClendon earned a base salary of $975,000 in 2012, with total remuneration of $16.9 million, according to company documents. However, McClendon also earns, and will continue to earn through June 2014, up to 2.5% in profits on wells that the company drills.

Anadarko’s Lawler to Lead Chesapeake

Anadarko Petroleum Corp. executive Robert Douglas Lawler, 46, was tapped Monday to helm Chesapeake Energy Corp., bringing with him a wealth of exploration and production (E&P) experience when he takes over as CEO on June 17.

Chesapeake Taps Anadarko Veteran to Succeed McClendon

Robert Douglas Lawler, 46, one of Anadarko Petroleum Corp.’s top exploration and production (E&P) executives, on Monday was named the new CEO of Chesapeake Energy Corp.

New York Fracking Foes Suffer Election Day Defeat

Most of the candidates who ran for office in New York on a platform opposed to hydraulic fracturing (fracking) were soundly defeated at the polls on Tuesday, but it was unclear if Republicans would maintain control of the state Senate with two races too close to call.

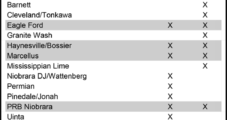

Crestwood CEO: Shales the Right Place for Midstream MLP

Crestwood Midstream Partners LP is a bit of an anomaly in the midstream sector as it is focused exclusively on shale plays, CEO Robert Phillips told financial analysts last week. It’s the only partnership that does so, save for the much larger Chesapeake Midstream Partners, he said.

Crestwood CEO: Shales the Right Place for a Midstream MLP

Crestwood Midstream Partners LP is a bit of an anomaly in the midstream sector as it is focused exclusively on shale plays, CEO Robert Phillips told financial analysts Tuesday. It’s the only partnership that does so, save for the much larger Chesapeake Midstream Partners, he said.

New York Considers Extending Frack Report Comment Period

The chief of New York’s Department of Environmental Conservation (DEC) said Thursday he was considering whether to extend a 60-day comment period on DEC’s hydraulic fracturing (fracking) report, which was issued in July.

Senate Tax Bill Gives Small Producers, Gas Processors a Break

Sen. Robert Menendez (D-NJ), who is not a proponent of the oil and natural gas industry, last Thursday re-introduced legislation that could raise taxes for major producers by more than $20 billion over the next 10 years. However, the bill gives small independent producers and refiners and natural gas processors a break.