Thanks to the Marcellus Shale, Houston-based Cabot Oil & Gas Corp. recently completed the best quarter in its history on an operational and financial basis. The company is adding a sixth rig in the play as it anticipates multiple infrastructure projects to come online in the months ahead, increasing the ability to get its gas to markets.

Relative

Articles from Relative

Pennsylvania Bills Would Expand NatGas Service in Heart of Marcellus

A pair of bills designed to tap “affordable natural gas in the MarcellusShale” and bring gas service to more consumers in Pennsylvania has been approved by the state’s Senate and moved to the House of Representatives for consideration.

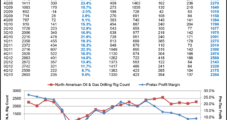

Baker Hughes Sees ‘Modest’ Uptick in U.S. Rig Count; Schlumberger Uncertain

No. 3 oilfield services provider Baker Hughes Inc. on Friday reported a 30% drop in first quarter profits, stung by weak North American drilling, its biggest market. Schlumberger Ltd., the world’s largest oilfield services operator, also reported a drop in quarterly profits on declines in North America, and management said the outlook for the United States and Canada this year remains uncertain.

Texas Producers Using, Recycling More Water

An update conducted last year of a Texas water use study found that oil and gas producers are using more water for hydraulic fracturing (fracking), but they’re also recycling more, making it important to distinguish between water “use” and “consumption.”

Pangea Taking ‘Bite-Sized’ Approach to LNG Export

Pangea LNG (North America) Holdings LLC, a relative latecomer to the North American liquefied natural gas (LNG) export race, is approaching regulators, and the market, with a smaller, more scalable project on the Texas Gulf Coast that the company’s CEO, an LNG veteran, says has better odds of coming to fruition than some mega project competitors.

Pangea Taking ‘Bite-Sized’ Approach to LNG Export

Pangea LNG (North America) Holdings LLC, a relative latecomer to the North American liquefied natural gas (LNG) export race, is approaching regulators, and the market, with a smaller, more scalable project on the Texas Gulf Coast that the company’s CEO, an LNG veteran, says has better odds of coming to fruition than some mega project competitors.

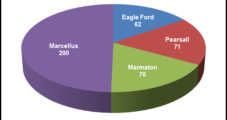

Moody’s ‘Positive’ on Liquids-Focused E&Ps

High prices for oil and natural gas liquids (NGL) relative to dry natural gas will continue to save the day for independent exploration and production (E&P) companies, Moody’s Investors Service said in a note Wednesday.

Chesapeake Results Disappoint; Largest Shareholder to Take ‘Active’ Role

Chesapeake Energy Corp. CEO Aubrey McClendon appeared to take it on the chin Wednesday, refusing to bow down to reports about the “unprecedented scrutiny” of the company and of himself in recent days, and promised shareholders that the management team is focused on becoming a U.S. oil-weighted giant. However, it’s going to take some time, he said, especially because the turnaround has little operational support from its natural gas-weighted portfolio.

Raymond James: U.S. Oil Rig Count May Decline in 2013

The U.S. government and private energy analysts appear to have come to a foregone conclusion that the domestic natural gas drilling rig count will take a dive in 2013, but if any are “blindly assuming” that the U.S. oil rig count will “continue to move up and to the right,” they may be wrong, said the team at Raymond James & Associates Inc.

Cheap Gas Has Some Strings, End-Users Say

Cheap natural gas, courtesy of shale plays, is bringing industry back to the United States, growing economies along the Gulf Coast, in the Northeast and elsewhere. But it has also made holding gas transportation capacity a more dicey prospect for end-users, and there is a risk that some of the energy industry’s risk management muscle could atrophy while on a diet of low prices and low volatility.