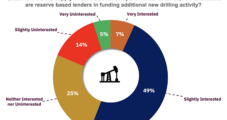

A more favorable commodities market for oil and gas prices often has led to more U.S. drilling activity, but producers into 2024 may face volatility and less-than-enthusiastic lenders, according to a new survey by Haynes and Boone LLP. The law firm’s semi-annual Borrowing Base Redeterminations Survey found that exploration and production (E&P) companies may not…

Tag / Redeterminations

SubscribeRedeterminations

Articles from Redeterminations

U.S. Oil, Natural Gas Producers Seen Having More Access to Capital This Fall

Exploration and production (E&P) companies that work in the United States are expected to have more reserve-based lending (RBL) capital available to them this fall versus last spring, according to the latest biannual survey conducted by Haynes and Boone LLP. The law firm conducts surveys ahead of each fall and spring redetermination season for RBL,…

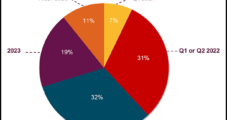

U.S. E&P Borrowing Base Seen Shrinking Amid Commodity Price Uncertainty

Available reserve-based lending (RBL) capital for exploration and production (E&P) companies is likely to shrink by 10-20% in the fall redetermination season, according to the latest biannual survey conducted by Haynes and Boone LLP. The law firm conducts surveys ahead of the spring and fall redetermination seasons for RBL, a common type of financing for…

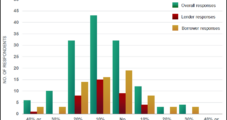

E&P Spring Redeterminations Follow Mediocre 4Q Results, Oil Price Decline

U.S. producers are likely to face a “conservative but not knee-jerk response” by banks as they begin spring borrowing base redeterminations, according to a survey by Haynes and Boone LLC.

Lenders Appearing More Optimistic as E&P Fall Redeterminations Beckon

Fall redetermination season for U.S. exploration and production (E&P) companies is about to begin, with lenders more optimistic about borrowing levels, while exploration and production (E&P) companies appearing to accept that low commodity prices may be sustained.

Chesapeake Resuscitated in Spring Redetermination, Visible Liquidity Into 2017

Spring redetermination season has proven to be more lenient than some may have expected, with Chesapeake Energy Corp.’s $4 billion credit line reaffirmed on Monday, giving the onshore producer a lifeline and financial cushion into 2017.

Chesapeake Resuscitated in Spring Redetermination, Visible Liquidity Into 2017

Spring redetermination season has proven to be more lenient than some may have expected, with Chesapeake Energy Corp.’s $4 billion credit line reaffirmed on Monday, giving the onshore producer a lifeline and financial cushion into 2017.

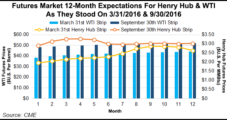

Higher Oil Prices Coming at Opportune Time For Spring Redetermination Season

Oil prices began to move higher in the last few days on an announcement that producers from in and outside the Organization of the Petroleum Exporting Countries (OPEC) will hold talks in mid-April to consider freezing output — news that may be favorable as U.S. operators meet with their lenders to redetermine their borrowing abilities.

U.S. E&Ps Arming For Spring Bank Redeterminations

The pain for U.S. exploration and production (E&P) companies may not be over as commercial banks begin their spring borrowing base redeterminations, which have the potential to reduce debt limits and begin a wave of restructuring, analysts with Raymond James & Associates said Monday.

Shift to Oily Shale Plays Bolsters E&P Operations, Says Moody’s

The ongoing oversupply of natural gas hasn’t deterred most independent exploration and production (E&P) companies from maintaining a robust drilling pace in the shale plays because of the shift by many to crude and natural gas liquids (NGL) for margin relief, Moody’s Investors Service said in a report.