Fitch Ratings Inc. has again downgraded the credit rating of Mexican state oil company Petróleos Mexicanos (Pemex), citing liquidity and environmental, social and governance (ESG) concerns. Pemex’s Long-Term Foreign and Local Currency Issuer Default Ratings (IDR) already were in junk territory at ‘BB-,’ and now have been lowered to ‘B+,’ the Fitch team said Friday…

Ratings

Articles from Ratings

Pemex Gets Dinged by Rating Agencies Ahead of López Obrador Taking Office

Fitch Ratings has revised its outlook for the international issuer default ratings (IDR) of Mexico’s national oil company Petróleos Mexicanos (Pemex) to negative from stable, because of concerns about its direction once the new administration takes office Dec. 1.

Southwestern Earning Higher Prices for ‘Responsibly’ Produced Natural Gas

A relative newcomer to the oil and natural gas industry may have found a way to monetize the upstream sector’s costly attempts to manage emissions and produce natural gas in a more responsible way using an asset rating system that could be applied to basins across the country.

Briefs — Leach XPress

Columbia Gas Transmission LLC (TCO) has restored a small percentage of flows on Leach XPress about a week after issuing a force majeure in response to an explosion on June 7 in Marshall County, WV that shut down the 1.5 Bcf/d line. The company has restored a segment allowing the Stagecoach-LXP meter to return to service. Nominations through the meter ramped to 107 MMcf/d shortly after TCO announced the repair and reached 190 MMcf/d on Friday (June 15). It’s unclear how long it will take to repair the rest of the line.

There’s Growth in NatGas Utilities, Fitch Says

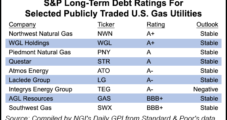

Local distribution companies’ (LDC) rusty old steel pipes have a silver lining: they offer organic growth opportunities that can often be easily financed through the rate base, according to Fitch Ratings. This is helping make LDCs the growth play in the broader utilities sector.

S&P Says Oil, NatGas Sector 30% of U.S. Distressed Debt in December

The U.S. distressed debt ratio reached a peak for the year at 24.5% in December — its highest since the 2009 recession — and the oil and gas sector accounted for about 30% of the debt issuers, according to a report by Standard & Poor’s Ratings Services (S&P).

Many E&Ps Still Accessing Capital Markets, With Cuts ‘Relatively Light,’ Fitch Says

The sky-is-falling scenario that producers were expected to face as crude oil prices collapsed last year has yet to make a big dent in lending, according to Fitch Ratings.

Kinder Affirms Commitment to ‘Investment Grade’

Three days after Moody’s Investors Service changed its outlook on Kinder Morgan Inc. (KMI) debt to “negative” from “stable,” the company said it “…will construct its 2016 plan to maintain an investment grade rating with all three [credit rating] agencies.”

BP’s Path Forward Clearer with Macondo Settlement, Says Moody’s

BP plc’s agreement to settle all the major federal, state and municipal claims related to the Macondo tragedy five years ago in the deepwater Gulf of Mexico led Moody’s Investors Service on Wednesday to upgrade the ratings to positive from negative.

S&P Lowers Southwest Gas Ratings on Recent Purchase

Standard & Poor’s Ratings Services (S&P) gave a thumbs-down Thursday to Las Vegas, NV-based Southwest Gas Corp.’s ratings based on the natural gas-only utility’s purchase of some Canadian pipeline construction companies for more than $200 million.