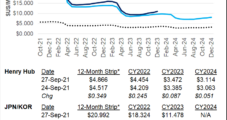

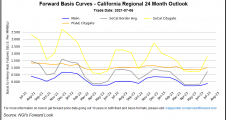

With dangerous heat leaving California electric grid operators struggling to meet heightened demand, natural gas forward prices in the southern part of the state rallied sharply from July 20-26, according to NGI’s Forward Look. Daytime temperatures have lingered at or above the century mark for most of July in parts of California, driving up cooling…

Rally

Articles from Rally

Freeport LNG Looks to Restart in November, Halting U.S. Natural Gas Price Rally

U.S. natural gas prices nosedived Tuesday afternoon after Freeport LNG Development LP outlined plans to restart partial operations at its export terminal on the Upper Texas Coast later than expected in November. The company had previously guided for a restart in early October. Initial production is now expected to begin in early to mid-November and…

As Futures Retreat from Highs, Natural Gas Forward Prices Ease Lower

As the relentless march higher for natural gas prices finally began to show signs of slowing down, forwards prices recorded discounts throughout the Lower 48 during the April 14-20 trading period, NGI’s Forward Look data show. Fixed prices for May delivery at benchmark Henry Hub eased 6.0 cents lower to end the period a hair…

Global Natural Gas Rally Continues as Fears Grow Over Winter Energy Shortages — LNG Recap

Natural gas prices across the world climbed higher on Tuesday, fueled by the prospect that there will be energy shortages from Europe to Asia this winter. British and Dutch benchmarks closed higher Tuesday, beating an all-time record set Monday after finishing close to $30/MMBtu. In the United States, prices also continued climbing toward $6 as…

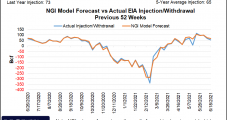

After Days-Long Rally, Natural Gas Forward Prices Retreat but Storage Concerns Simmering

After a massive rise in the prior week, natural gas forwards softened a bit in the trading period ending July 7. Cooler weather and returning production contributed to a 7.0-cent decline in August prices, with small decreases extending through the remainder of summer (August-October), according to NGI’s Forward Look. Winter forward prices also fell, but…

Exports Playing Big Role in Henry Hub Strength — LNG Recap

U.S. natural gas prices finally retreated Tuesday after the longest stretch of gains in two decades, but warmer forecasts and a tight global market are seen keeping the outlook bullish. Unrelenting heat from the East to West Coasts, coupled with increasingly strong international demand for liquefied natural gas (LNG), helped the Henry Hub front month…

Chevron Moving Ahead With Gorgon Compression Project — The Offtake

A roundup of news and commentary from NGI’s LNG Insight Chevron Corp. said Friday it would move ahead with a $4 billion project to boost compression from its Jansz-Io field in Australia. The project would take about five years to complete and is aimed at maintaining supplies to the three liquefaction trains at the company’s…

European Natural Gas Continues Charge Upward, Hits Record — The Offtake

A roundup of news and commentary from NGI’s LNG Insight A global commodity rally continued Thursday. Dutch gas futures soared to an all-time record by jumping above $12/MMBtu, while spot LNG prices in North Asia were assessed near $14. In the United States, the Henry Hub prompt contract increased by 1 cent to close at…

Natural Gas Futures Rally as Plant Issues Reverse Earlier Decline; AECO Cash Up on Compressor Issues

Seven proved to be the natural gas market’s lucky number on Wednesday. Nymex futures managed to overcome an early decline and extended their streak of consecutive gains another day. The August Nymex futures contract settled 2.0 cents higher day/day at $3.650. September edged up 1.8 cents to $3.624. Spot gas prices, however, buckled across the…

Europe, Asia Battle for Natural Gas as Price Rally Continues — The Offtake

A roundup of news and commentary from NGI’s LNG Insight Global gas benchmarks recorded another day of gains Friday. Europe’s Title Transfer Facility again grabbed headlines. The front-month contract climbed for a seventh straight day, continuing its push above $11/MMBtu. Tudor, Pickering, Holt & Co. (TPH) said European storage built by 79 Bcf this week,…