The bankruptcy case of Quicksilver Resources Inc. took several turns on Wednesday. The company closed on the court-approved sale of some of its assets in the Barnett Shale to BlueStone Natural Resources II for $245 million, and Crestwood Equity Partners LP said it struck a 10-year gathering and processing agreement with BlueStone.

Tag / Quicksilver

SubscribeQuicksilver

Articles from Quicksilver

Midstream Companies Bracing for E&P Bankruptcy Rulings

Midstream companies are bracing for rulings in a pair of bankruptcy court cases involving distressed exploration and production (E&P) companies.

Brief — Quicksilver

On Wednesday the U.S. Bankruptcy Court in Delawareapproved the sale of Quicksilver Resources Inc.’s U.S. oil/gas assets for $245 million to Tulsa-based private equity firm BlueStone Natural Resources II(see Shale Daily, Jan. 25). The sale was consummated in a bankruptcy court-approved auction that Quicksilver held earlier this month. The sale included U.S. oil and natural gas assets located primarily in the Barnett Shale in the Fort Worth Basin of North Texas, as well as assets in the Delaware Basin in West Texas that are concentrated in Pecos County, TX, and to a lesser extent Crockett and Upton counties. Quicksilver’s Canadian assets are not part of the bankruptcy and will be sold separately, the company said.

Briefs — West Virginia Cracker, Chesapeake, Quicksilver

West Virginia Department of CommerceSecretary Keith Burdette said Thursday at an industry conference in Pittsburgh that the state expects Odebrecht SA affiliateBraskem SA to acquire additional tracts of property in Parkersburg in the coming weeks for its proposed multi-billion dollar ethane cracker. In April 2015, the companies said plans for the ethane cracker in Wood County, WV, would be postponed pending further project analysis amid the commodities downturn (see Shale Daily,April 23, 2015). But Burdette, who supports the facility, noted that neither Braskem, nor PTT Global Chemical (PTTGC) pcl and Shell Chemical Appalachia LLC, which have also proposed crackers in Ohio and Pennsylvania, respectively, have scrapped plans for their projects. Burdette said his office expects Braskem to acquire more land sometime by the end of 1Q2016. He added that his office stays in close touch with the company and others that have made similar proposals for the region. He said that Braskem, Shell and PTTGC have each “expressed a desire” to push final investment decisions until 2017. Braskem has filed for certain permits for the cracker and has been acquiring land in Wood County since about 2013, when the facility was first announced (see Shale Daily,Aug. 27, 2014;May 19, 2014;Nov. 14, 2013).

Quicksilver U.S. Assets Fetch $245M at Auction from Private Equity Firm

Tulsa-based private equity firm BlueStone Natural Resources II has reportedly purchased the U.S. assets of bankruptcy-immersed Quicksilver Resources Inc. for $245 million, according to a company announcement Saturday. An auction was held last Wednesday and Thursday (see Shale Daily,Jan. 20).

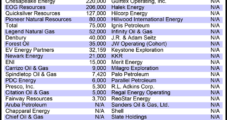

Quicksilver Holding Auction for U.S. Assets; Canadian Sale to Come Later

Quicksilver Resources Inc. put its U.S. assets, including one-time high-valued ones in the Barnett Shale, on the auction block Wednesday as part of its Chapter 11 voluntary bankruptcy filing last March (see Shale Daily, Feb. 18, 2015). The Fort Worth, TX-based energy company’s Canadian assets, which were not part of the bankruptcy, would be sold separately.

Canada Permits Quicksilver’s Discovery LNG Project

British Columbia's aspiring liquefied natural gas (LNG) industry spread into prime eco-tourism territory, when a tanker terminal scheme on Vancouver Island obtained a 25-year federal license to export up to 2.6 Bcf/d.

Canada Permits Quicksilver’s Discovery LNG Project

British Columbia’s aspiring liquefied natural gas (LNG) industry spread into prime eco-tourism territory, when a tanker terminal scheme on Vancouver Island obtained a 25-year federal license to export up to 2.6 Bcf/d.

Heavy Metals Found in Barnett Area Water, But Source Unknown

A study of Barnett Shale region water wells has found elevated levels of heavy metals near natural gas extraction sites, but a link to drilling/production activity has not been determined and may not be, researchers from the University of Texas at Arlington (UTA) said.

Quarterly Briefs

Quicksilver Resources Inc. is continuing to “hammer on the cost side” of its business, deferring elective spending in the energy patch and cutting back on staff. A recently announced joint venture (JV) in the Barnett Shale with Tokyo Gas Co. Ltd. was welcome news (see NGI, April 8), but there is more work ahead. “We are focused on the most important projects and we’re bringing in partners to both reduce debt and assist in the development of our assets,” said CEO Glenn Darden. “The company is very serious about reducing costs and living within cash flows.” Over the last year, the employee count has come down by about 20%. The Fort Worth, TX-based operator reported an adjusted net loss of $6 million (minus 4 cents/share) compared with a loss in 1Q2012 of $15 million (minus 9 cents). Since it was able to complete a long-sought Barnett Shale deal and in light of “challenging” natural gas liquids pricing, the company has shelved plans to create a Barnett master limited partnership (see NGI, Nov. 12, 2012).