Gulf of Mexico explorer McMoRan Exploration Co. (MMR) is no longer a publicly traded stock after shareholders on Monday (June 3) approved a merger with a subsidiary of affiliated conglomerate Freeport-McMoRan Copper & Gold Inc. Under a friendly agreement in late 2012, Freeport agreed to pay close to $3 billion for MMR and more than $9 billion including debt for Plains Exploration & Production Co.; the Plains deal closed at the end of May (see Daily GPI, June 3; Dec. 6, 2012). Freeport Chairman Jim Bob Moffatt co-chaired McMoRan with Freeport CEO Richard Adkerson. MMR shareholders are to receive $14.75/share in cash, or $2.2 billion for shares not owned by Freeport, as well as 1.15 units in Gulf Coast Ultra Deep Royalty Trust, which would hold a 5% overriding royalty stake in future output from 20 specified ultra-deep exploration targets.

Publicly

Articles from Publicly

Massachusetts Firm Sets Bi-Coastal Virtual Oil Pipeline

With acquisitions and infrastructure agreements in hand, Waltham, MA-based Global Partners LP, a publicly traded master limited partnership, is establishing a “virtual pipeline” for shipping North Dakota Bakken and Canadian crude oil to refineries on both the U.S. West and East Coasts.

California Report: ‘Scientific Uncertainty’ on Fracking’s Water Impact

There is still too much “scientific uncertainty” surrounding hydraulic fracturing’s (fracking) impact on water supply, and because of this regulators and operators need to be more transparent and accountable, according to a University of California, Berkeley, report that was released last Thursday.

Big Paydays for Big Energy CEOs

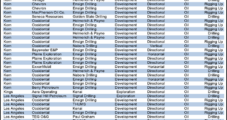

Nearly a dozen CEOs of large U.S.-based publicly owned oil and gas companies earned some of the biggest compensation packages in the country last year, according to preliminary data compiled by Equilar, an executive compensation data firm.

Big Paydays for Big Energy CEOs

Nearly a dozen CEOs of large U.S.-based publicly owned oil and gas companies earned some of the biggest compensation packages in the country last year, according to preliminary data compiled by Equilar, an executive compensation data firm.

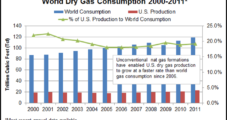

Enough Gas to Fight Over, Thanks to Shales

Besides powering a manufacturing/petrochemical industry renaissance, North America’s abundant supply of shale gas is fueling a war of words over the merits of energy exports versus domestic usage.

ExxonMobil Still Global Energy’s Heavyweight Champ

ExxonMobil Corp. continues to reign supreme as the world’s top energy enterprise and has regained its title as the largest domestic publicly traded entity.

Industry Brief

A recently combined and publicly held exploration and development company, Salt Lake City-based Richfield Oil and Gas Co., announced a purchase in the Graham Reservoir oilfield in Uinta County, WY. Richfield bought a shut-in well in the Wasatch National Forest (Well #16-15) from Frontier Energy for $610,000, including 640 acres of mineral leases. The company said the purchase gives it 100% working interest in a mineral lease in the Graham Reservoir, located approximately 120 miles northeast of Salt Lake City in southeastern Wyoming. The well has been shut in since 2003 and was completed in the Dakota Formation at 15,600 feet. Flow testing and production operations will get underway later in the first quarter. For Richfield, which is the product of the merger of Hewitt Petroleum Inc. and Freedom Oil & Gas Inc. in 2011, the acquisition is part of the process of “methodically building our reserve and production base” through graded acquisitions,” said CEO Douglas Hewitt.

Producers, States Press BLM to Withdraw Fracking Rule

States and producers Monday called on the Obama administration to either withdraw or suspend a proposed rule that would require companies to publicly disclose chemicals used in hydraulic fracturing (fracking) operations on federal and Indian lands. Environmental and conservation groups lobbied for the federal government to tighten the rule.

Chesapeake Expects Gas Prices to Strengthen, Says McClendon

Chesapeake Energy Corp. CEO Aubrey McClendon, who Thursday spoke to analysts publicly for the first time in months beyond the Oklahoma City boardroom, said the company remains on track to sell up to $14 billion of assets by the end of the year, including a package of properties in the Permian Basin. He’s also confident that even as the company continues to turn toward more oily production, natural gas prices will strengthen in the coming months.