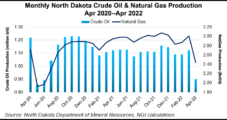

News that Continental Resources Inc. may be taken private should come as no surprise, according to North Dakota’s top oil and gas regulator. Continental is the largest producer in the oily Bakken Shale, which accounts for 96% of the state’s production. Executive Chairman Harold Hamm announced he is seeking to purchase all outstanding shares in…

Private

Articles from Private

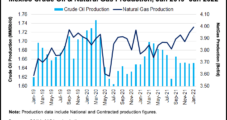

Russian Firm’s New Acquisition Drives Mexico Oil Production Growth

Private sector oil production in Mexico hit a record high of 86,056 b/d in January, up from the previous high of 74,809 b/d set in December and 53,064 b/d in January 2021, according to upstream regulator Comisión Nacional de Hidrocarburos (CNH). The 62% year/year increase was driven largely by Fieldwood Energy LLC, which until last…

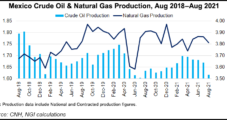

Fatal Platform Fire Dents Pemex Oil, Natural Gas Production in August

Oil production in Mexico averaged 1.62 million b/d in August, down from 1.67 million b/d in July and 1.63 million b/d in August 2020, according to the data from upstream regulator Comisión Nacional de Hidrocarburos (CNH). Output by national oil company Petróleos Mexicanos (Pemex) fell from 1.61 million b/d in July to 1.55 million b/d…

Greater Wattenberg-Focused Extraction Oil Prepares For Nasdaq Debut

Denver-based Extraction Oil & Gas LLC said Thursday it expects to raise as much as $600 million in a public offering, which would value the Rocky Mountain-focused producer at about $2.6 billion.

Mexico’s First Independent E&P Secures $525M in Private Investments

Mexico’s first independent exploration and production (E&P) company is securing its initial $525 million in funding with the help of private equity (PE) investors, including two big U.S. firms.

Mexico’s President Proposes More Private Energy Investment

In a nation where citizens’ national identity is tied to the state-owned oil and natural gas industry, and past high-profile efforts to inject more global private-sector investment have withered, Mexican President Enrique Pena Nieto on Monday proposed opening the nation to more shared private-sector energy investment.

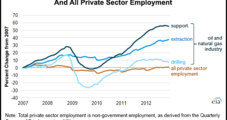

Oil and Gas Industry Employment Grew 40% Over Six Years

In the six years spanning 2007 through 2012, total U.S. private sector employment increased by more than one million jobs, or about 1%. However, over the same period, the oil and gas industry — segmented into drilling, extraction and support segments — increased by more than 162,000 jobs, which equates to a 40% increase,” according to a new study from the U.S. Labor Department’s Bureau of Labor Statistics (BLS).

Private E&Ps Finding Success Again and Again with PE Backing

Private equity (PE) continues to put a bead on funding U.S. exploration and production (E&P) companies, and there appears to be a lot more money available than ever before, unconventional operators said at the Colorado Oil & Gas Association’s Rocky Mountain Energy Summit in Denver.

Group Says Pennsylvania Bill Would Allow Forced Pooling

A national organization that supports oil and gas leaseholders is furious that Pennsylvania legislators passed a bill that its members claim would allow forced pooling in the state. They are urging people to contact Gov. Tom Corbett to get a veto.

People

Former Anadarko Petroleum Corp. chief Jim Hackett was appointed to co-lead the Houston office of private energy investment giant Riverstone Holdings LLC. Hackett stepped down as Anadarko CEO in 2012 and retired as executive chairman in May; he still plans to pursue a master’s degree in theological studies at Harvard Divinity School, completing a two-year program over the next four years (see Daily GPI, March 12). Working at Riverstone is “a way to still stay in touch with a business I love as a principal, but to do it very much in light of my primary duty, which is to go back to school.” Riverstone, founded in 2000, has nearly $24 billion in seven investment funds, with equity invested in operators that include deepwater explorer Cobalt International Energy Inc., midstreamer Magellan Midstream Partners LP and UK shale explorer Cuadrilla Resources Ltd.