Given current commodity prices, natural gas wells drilled in the Marcellus Shale — wet or dry — compete favorably with marginal Bakken Shale oil wells, but that’s the only gas play in the U.S. onshore that today can compete with Bakken oil well economics, according to an analysis by Barclays Capital.

Portions

Articles from Portions

EPA, Pennsylvania DEP Decline to List Susquehanna as Impaired

The U.S. Environmental Protection Agency (EPA) said it agrees with the Pennsylvania Department of Environmental Protection (DEP) over not listing a nearly 100-mile section of the main stem of the Susquehanna River at the foot of the Marcellus Shale as an impaired waterway, despite concerns over the health of the river’s smallmouth bass.

Pennsylvania PUC Asks Localities to Fix Impact Fee Forms

The Pennsylvania Public Utility Commission (PUC) has asked about 70 municipalities to correct and resubmit a form showing how they spent their share of impact fee revenue from Act 13, the state’s omnibus Marcellus Shale law.

El Paso Seeks Willcox Lateral Expansion Start-Up

El Paso Natural Gas, a Kinder Morgan pipeline, has asked FERC for authorization to place the remaining portions of the expansion of its Willcox Lateral into service. The pipeline will make more natural gas available for delivery to power plants in northern Mexico.

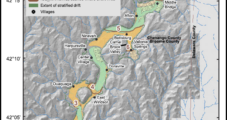

USGS: Shale Underlies Some of Susquehanna Valley’s Prime Aquifers

Portions of the Susquehanna River Valley aquifer in an area of New York that overlies the Marcellus and Utica shales are among the most favorable for potential large-scale groundwater supply, according to a U.S. Geological Survey (USGS) study.

Midwest, Midcontinent Strength Offset Northeast Weakness

The physical gas market overall on average Thursday was unchanged, but once the wide-swinging Northeast pipes that include Algonquin, Iroquois and portions of Tennessee are factored in, the picture changes to a loss of 21 cents. Most cash trades were completed before the 10:30 a.m EST release of storage data by the Energy Information Administration (EIA), but the 157 Bcf withdrawal was less than the market was expecting, and futures slumped. At the close March had dropped 14.3 cents to $3.163 and April was off 14.0 cents to $3.231. March crude oil fell 30 cents to $97.31/bbl.

Northeast Leads Broad Decline, But Futures Stay In Range

Physical natural gas prices on average plunged 77 cents Monday, but free-falling prices on Northeast pipelines such as Algonquin, Iroquois and portions of Tennessee and Transco skewed the results. If those points are taken out of the mix, the decline was 10 cents. At the close of futures trading March had fallen 0.7 cent to $3.279 and April was down 0.9 cent to $3.346. March crude oil added $1.31 to $97.03/bbl.

Northeast Leads Broad Retreat; Futures Plunge on EIA Data

Cash prices fell 13 cents on average Thursday, but if the big-dollar losses sustained on Algonquin, Iroquois, as well as portions of Tennessee and Transco are factored out, the market fell only a penny.

Northeast Tumbles, East Weakens, and California Steady

Spot natural gas prices on average fell 37 cents Monday, but if volatile New England pipes such as Algonquin, Iroquois and portions of Tennessee are factored out, the decline was about 3 cents.

Northeast-led Advance Offsets Scattered Weakness

The cash market overall averaged 9 cents higher Friday as eastern portions of the country were still in the crosshairs of a major storm that traversed the country earlier in the week. The advance was broad and led by New England locations, and the isolated points that did show losses endured setbacks of a couple of pennies or less. January futures fell 1.1 cents to $3.451, and February gave up 1.3 cents to $3.482. February crude oil shed $1.47 to $88.66/bbl.